The 7 Fastest Business Loans for Startups in 2025 (That Actually Fund)

Startup life moves fast. You don’t always have time to wait weeks for a bank loan to clear. Whether you’re launching a new product, hiring your first team, or covering cash flow in the early stages, getting funded quickly can make or break your momentum.

That’s why we’ve compiled the 7 fastest business loans for startups in 2025 that actually fund. These aren’t just theoretical options — they’re startup-friendly lenders that approve and fund fast, with many offering 24-hour business loans or even same-day approvals.

Let’s dive into what makes these options the best for startup business funding this year — including approval speed, funding time, credit pull type, and how to apply.

1. National Funding – Best Overall for Fast Startup Loans

Approval Speed: Same Day

Funding Time: 24 to 48 hours

Credit Pull: Soft Pull Prequalification Available

When speed is your top priority, National Funding delivers. They specialize in fast business loans — with many startups approved in hours and funded the very next day. You can prequalify without impacting your credit score, and their team is highly rated for customer service.

They’re especially helpful for startups that need flexibility: short repayment terms, manageable daily or weekly payments, and no requirement for years of business history.

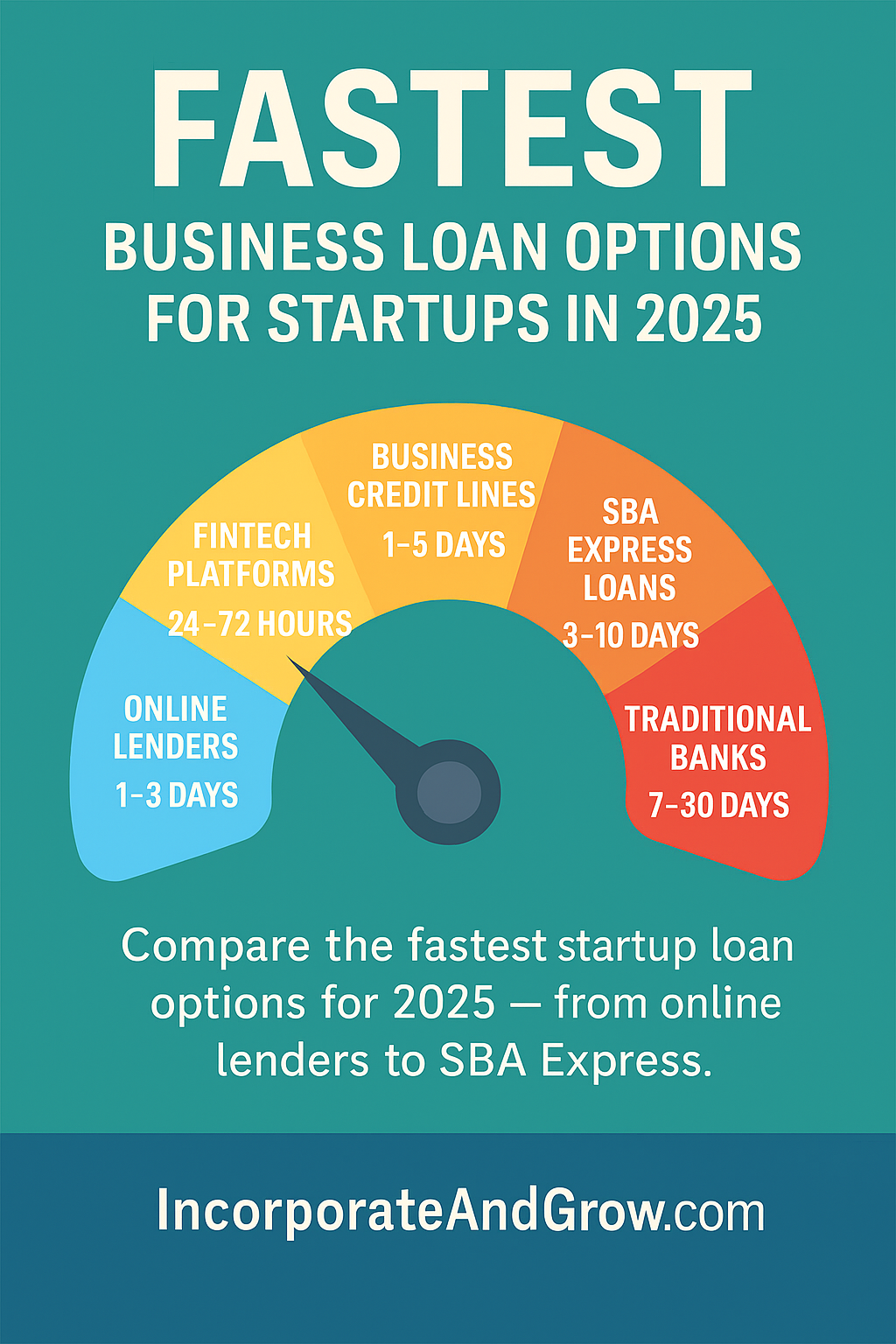

Infographic: Fastest Business Loan Options for Startups in 2025 — by IncorporateAndGrow.com

Best for: Founders who want fast cash without jumping through traditional hoops.

Apply with National Funding now »

2. FundWise Capital – Best for Soft Pull Business Credit

Approval Speed: 24–48 Hours

Funding Time: As little as 3–5 Days

Credit Pull: Soft Pull Prequalification

FundWise Capital helps startups access unsecured business credit lines with a soft credit pull, which means you can see what you qualify for without damaging your score. They pair you with the best funding program based on your credit and business goals, making it ideal for founders just starting out.

Best for: Startups looking for credit lines with flexibility and no collateral.

3. Fund & Grow – Best for High Credit Founders

Approval Speed: 1–3 Days

Funding Time: 1–2 Weeks

Credit Pull: Soft Pull to Prequalify, Hard Pull Post Approval

Fund & Grow helps qualified founders access $50,000–$250,000 in 0% interest business credit using a proven batch-application strategy. While funding may take slightly longer than others on this list, the credit amounts and low-cost structure make it worth the wait for strong credit founders.

Best for: Founders with 700+ credit scores looking to maximize capital at minimal cost.

See if you qualify for $250K at 0% »

4. American Express Business Cards and Loans – Best for Perks + Speed

Approval Speed: Instant Online Approval Possible

Funding Time: Within Minutes (Virtual Cards)

Credit Pull: Hard Pull (Personal)

American Express Business Cards and Loans give startup founders access to purchasing power, rewards, and cash flow tools — often with instant online approval. Virtual cards can be issued within minutes so you can start spending immediately on marketing, inventory, or other early expenses.

Best for: Startups that spend regularly and want travel or cashback rewards.

Explore Amex Business Cards and Loans »

5. SBA Microloans – Best Government-Backed Option

Approval Speed: 5–10 Business Days

Funding Time: Up to 2 Weeks

Credit Pull: Hard Pull

Offered through local intermediaries, SBA Microloans offer up to $50,000 in low-interest startup capital, often with hands-on support. The timeline is slower than private lenders but still fast by government standards.

Best for: Founders with a business plan and local nonprofit lender support.

6. Lendio – Best for Comparing Fast Loan Offers

Approval Speed: 1–3 Days

Funding Time: 2–7 Days

Credit Pull: Varies by Partner Lender

Lendio is a loan marketplace that helps startups compare multiple offers from fast lenders. While Lendio itself doesn’t lend, they match you to partners that may fund quickly depending on your profile. Their support team helps you through the process.

Best for: Startups that want to compare lenders with one application.

7. PayPal Working Capital – Best for Ecommerce Startups

Approval Speed: Instant (If Eligible)

Funding Time: Same Day

Credit Pull: No Personal Credit Check

Available to PayPal business users, PayPal Working Capital loans are based on your sales history — not your credit score. If your startup accepts PayPal payments, you could qualify for a fast loan with automatic repayment from future transactions.

Best for: Ecommerce startups and digital service providers using PayPal.

Final Thoughts: Speed + Strategy = Smart Startup Funding

When time is tight, these startup loan options stand out for their ability to approve and fund fast — without sacrificing quality. Whether you need $5K to launch your MVP or $200K to scale your operation, there’s a funding solution here for you.

We recommend starting with National Funding to see what you qualify for — then comparing with options like FundWise or Fund & Grow depending on your credit and business stage.

Want a deep dive into business credit strategies that don’t require loans? Read our guide on How Fund & Grow Helps You Get $250K in Business Credit.

Or, if you’re looking for lightning-speed funding, check out the best 24-hour business loan options now.

Need funding today? Apply with National Funding here and get a decision in hours.