Fast Business Loans with Minimal Paperwork: Get Approved in 24 Hours

When your business needs capital now — not next quarter — traditional financing just won’t cut it. Here’s how to get fast business loans with minimal paperwork and funding in as little as 24 hours.

Introduction: The Urgency of Cash Flow for Founders

In the fast-paced world of startups and small businesses, speed is everything. Whether you’re managing a seasonal surge, covering unexpected payroll, or jumping on an immediate growth opportunity, waiting weeks for funding isn’t just frustrating — it could cost you the momentum you’ve worked so hard to build. This is where fast business loans with minimal paperwork become essential.

The problem? Most traditional business loans come with a lengthy process:

- Endless paperwork and documentation requirements

- Weeks of back-and-forth with underwriters and multiple approval stages

- Often require personal guarantees and significant collateral

- Higher rejection rates, especially for newer businesses or those without perfect credit

That’s why a new breed of online and fintech lenders—like National Funding—are changing the game by offering fast, flexible business loans with truly minimal paperwork and the potential for next-day funding.

In this comprehensive guide, we’ll explore:

- What fast business loans are and how they differ from traditional options

- Why they’re ideal for growth-stage founders and urgent capital needs

- The trade-offs and considerations when opting for speed-based capital

- Where to get started with trusted partners and affiliate links

Affiliate Highlight: National Funding — Offers up to $500,000 in capital with just a simple application and 4 months of business bank statements. No SBA red tape. Funding in as little as 24 hours.

Why Speed Matters in Business Funding

Founders don’t just need funding — they need timing. Fast business loans with minimal paperwork can make a crucial difference in scenarios like:

- Seizing Missed Opportunities: Instantly capitalize on inventory discounts, potential acquisitions, or lucrative contracts that require immediate upfront capital.

- Bridging Cash Flow Gaps: Confidently cover operating expenses during seasonal lulls, unexpected dips in revenue, or payment delays from clients.

- Addressing Emergency Needs: Swiftly manage unexpected expenses like critical equipment repairs, urgent team expansion, or short-term market downturns without disrupting operations.

Unlike slow-moving venture capital rounds or bureaucratic SBA loans, fast business loans are designed for immediacy and agility. There’s no need for lengthy pitches to investors or submitting complex, 30-page business plans.

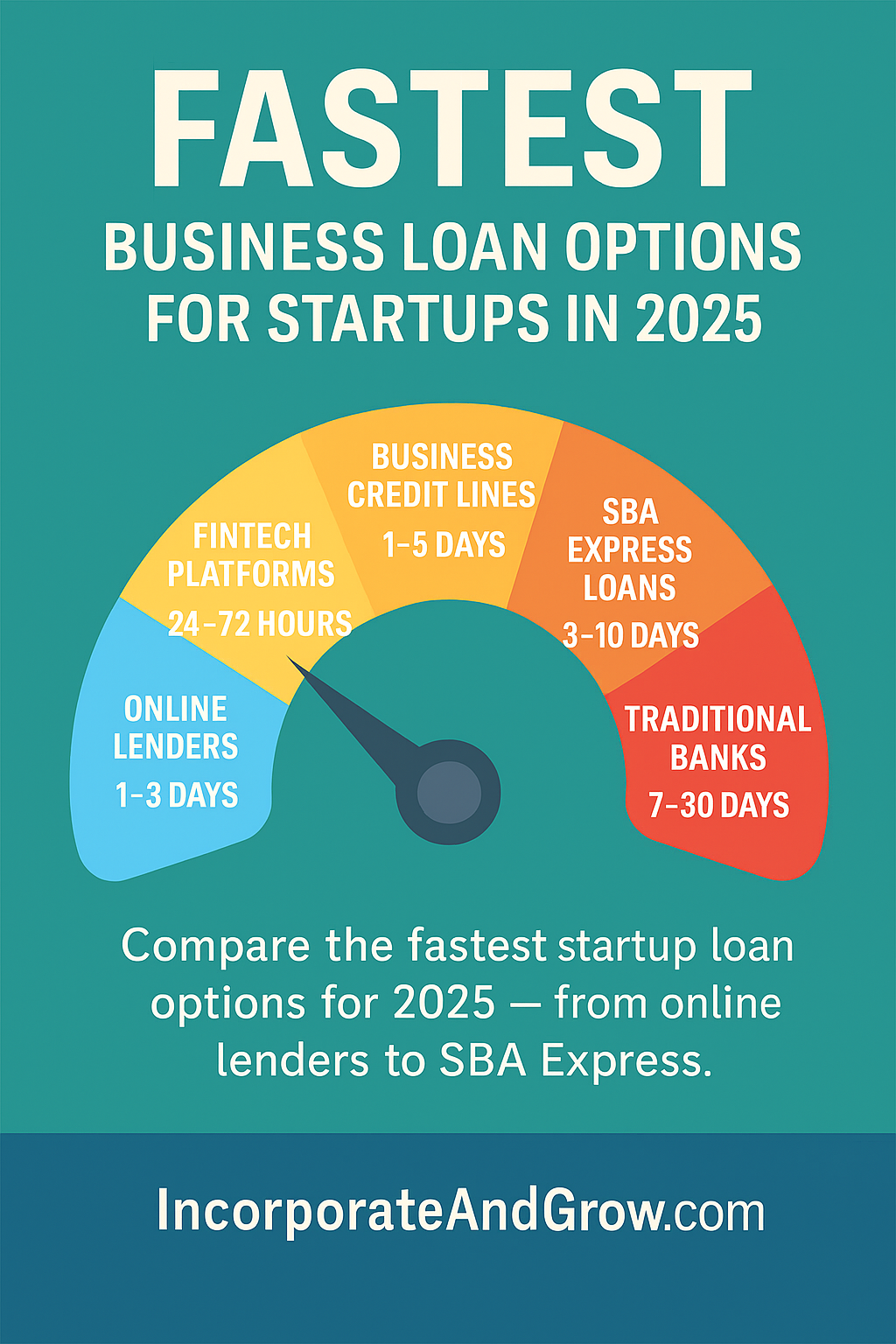

The process is streamlined: typically, just an online application, a few months of your business bank statements, and a quick 24–72 hour turnaround for funds.

What Are Fast Business Loans and How Do They Work?

Fast business loans are short- to medium-term funding products typically offered by online lenders and fintech companies that prioritize speed and accessibility over traditional, time-consuming underwriting processes. They are often a type of working capital loan or a merchant cash advance.

Key features that enable quick funding:

- Simplified Online Applications: The entire process, from application to approval, is often digital and straightforward.

- Rapid Approval Times: Decisions are typically made within 24–48 hours of application submission.

- Expedited Fund Deposits: Approved funds are usually deposited directly into your business bank account within 1–2 business days.

- Minimal Paperwork: Instead of extensive financial statements and business plans, lenders often only require recent business bank statements (typically 3-6 months) to assess your cash flow.

- Flexible Credit Requirements: Many fast loan providers focus on your business’s revenue and cash flow rather than solely on your credit score, leading to higher approval odds for businesses with subprime credit.

The Power of E-Signatures in Rapid Loan Approval

A significant factor contributing to the speed of fast business loans is the widespread adoption of **e-signatures**. Many online lenders offer fully digital application processes, allowing you to sign documents electronically from anywhere, at any time. This eliminates the need for printing, scanning, or mailing physical paperwork, dramatically cutting down the time from application submission to approval and funding. The ability to e-sign agreements is a cornerstone of the ‘minimal paperwork’ promise, ensuring a truly streamlined and rapid experience, often leading to funding in as little as 24 hours.

These loans are often offered by non-bank lenders, like National Funding, who use revenue-based underwriting to assess creditworthiness more dynamically, allowing for quicker decisions and funding.

Meet National Funding: Your Partner for Speed-Based Capital

Founded in 1999, National Funding has funded over $4 billion to more than 75,000 small businesses across the United States. They specialize in providing businesses with working capital and equipment financing.

Their model is built on addressing what founders care about most when it comes to urgent capital needs:

- Funding in 24 hours: Get access to the capital you need almost immediately.

- Minimal Documentation: Only 4 months of business bank statements are typically required for an application.

- Generous Funding Amounts: Access up to $500,000 in working capital.

- Flexible Credit Requirements: A credit score of 600+ FICO is generally accepted.

- No Collateral Required: You won’t need to put up business assets as security for unsecured loans.

National Funding is not a fit for startups under 6 months old or businesses under $250K in annual revenue. However, for any established U.S. business meeting those marks, it’s one of the fastest and most accessible lenders available, making it an excellent option for fast business loans with minimal paperwork.

Ready for fast business funding?

→ Apply for Fast Business Funding with National Funding Today

Tracking Note: This link uses a compliant affiliate pixel and ensures you’re properly credited for referrals.

Fast Loans vs. Traditional Business Loans: A Comparison

| Feature | Fast Business Loans | Traditional Bank Loans |

|---|---|---|

| Speed of Funding | 24–72 hours | 2–8 weeks (or longer) |

| Paperwork Required | Minimal (1–2 documents, typically bank statements) | Extensive (tax returns, business plan, financial statements, projections, etc.) |

| Credit Requirements | 600+ FICO, strong focus on cash flow and revenue | 680+ FICO and often strong collateral required |

| Maximum Funding | Up to $500K (can vary by lender) | $50K–$5M+ |

| Collateral | Not typically required for unsecured options | Often required for security |

| Flexibility of Use | High (working capital, inventory, payroll) | Can be specific (equipment, real estate) or general |

| SBA Compliance | Not applicable | Often necessary for government-backed loans |

| Cost (APR) | Generally higher due to speed and risk profile | Generally lower due to longer terms and stricter requirements |

Want to compare more funding tools? Read Our Business Funding Toolkit

Who Are Fast Business Loans Best For? Ideal Use Cases

Fast business loans with minimal paperwork are perfect for established businesses facing immediate capital needs or seeking to seize time-sensitive opportunities:

- Service providers experiencing seasonal fluctuations who need to stabilize cash flow during slower months.

- E-commerce sellers needing working capital to purchase inventory quickly for a surge in demand or to cover marketing costs.

- Contractors and trades managing upfront project costs, such as materials or labor, before client payments are received.

- Agencies scaling new client accounts that require immediate investment in staff or resources.

- Retail businesses dealing with unexpected equipment failure, sudden inventory gaps, or a need for rapid expansion.

If your business is earning consistent revenue (typically at least $250K annually) and has a dedicated business bank account (opened for at least 6 months), you’re likely eligible for these types of fast funding solutions.

Internal Support: Build a Lendable Business Foundation

While fast business loans offer quick access to capital, having a strong internal foundation will always improve your funding prospects and loan terms. Before applying, make sure your business is set up for success:

1. Choose the Right Business Structure

Your business entity matters significantly for both liability protection and funding eligibility. An LLC, S-Corp, or C-Corp provides more credibility and allows for separation of personal and business finances, which lenders prefer.

Read our guide: How to Structure Your Business for Funding Success (LLC vs. S-Corp vs. C-Corp)

2. Separate Your Finances with Dedicated Tools

Maintaining clear, separate financial records for your business is non-negotiable for funding. Use dedicated tools to streamline your bookkeeping and accounting:

- Bench – Offers done-for-you bookkeeping services by a team of professionals, ensuring accurate and compliant financial records.

- Xero – Provides robust cloud accounting software for modern businesses, allowing you to track expenses, manage invoices, and monitor cash flow in real-time.

Pro tip: Clean, consistent bookkeeping is one of the biggest green flags for lenders and can significantly speed up your funding application process.

Final Thoughts: Get Funded, Fast, and Grow Your Business

The capital your business needs to seize opportunities, manage cash flow, and achieve growth is often just one step away — if you know where to look and how to prepare.

National Funding gives established founders access to real money on a realistic timeline, without the lengthy bureaucracy of big banks or the dilution of outside investors. Their focus on fast business loans with minimal paperwork makes them an ideal partner for dynamic businesses.

If you’ve been in business for at least 6 months, have consistent revenue (at least $250K annually), maintain a 600+ credit score, and need capital now…

This is your sign to explore fast funding options.

→ Apply with National Funding Today and Get Your Capital Fast

Tracking Note: This link uses a compliant affiliate pixel and ensures you’re properly credited for referrals.

Additional Resources for Founders Seeking Funding

- Business Credit vs Business Loans: Which Fuels Faster Growth?

- LLC vs Sole Proprietorship for Funding: Which is Best?

- Fund & Grow Business Credit Review: Get 0% Interest Funding

- FundWise Capital: Unsecured Business Funding up to $150K