Fundwise Credit Score Requirements: Your Guide to Unsecured Business Funding

As a founder, navigating the world of business funding can be complex. While traditional banks often demand perfect credit and extensive collateral, platforms like Fundwise Capital offer a different pathway, especially for those seeking unsecured business funding. But what exactly are Fundwise’s credit score requirements, and how can you prepare your business to qualify?

This comprehensive guide will break down everything you need to know about Fundwise’s approach to creditworthiness, their streamlined funding process, the types of capital they offer, and crucial steps you can take to maximize your approval odds.

Understanding Fundwise Capital: A Unique Approach to Funding

Fundwise Capital stands out in the funding landscape by specializing in unsecured business funding, primarily through business credit lines and credit cards with 0% introductory APR periods. Their model is built on providing founders with quick access to capital without the typical collateral demands of traditional loans.

Unlike lenders who solely scrutinize your business’s financial history, Fundwise often leverages a blend of personal and business credit profiles, combined with revenue analysis, to determine eligibility and funding amounts. This nuanced approach opens doors for many entrepreneurs who might not qualify for conventional bank loans.

Fundwise Credit Score Requirements: What You Need to Know

When assessing eligibility for funding, Fundwise Capital looks at a combination of factors, but a strong personal credit score is often a primary consideration for unsecured lines of credit, especially for newer businesses. Here’s what they generally look for regarding your Fundwise credit score:

- Personal FICO Score: While Fundwise doesn’t publish an exact minimum, generally, a personal FICO score of 680 or higher is preferred to qualify for their best unsecured funding options. Scores above 700 will significantly improve your chances and potential funding limits.

- Credit History: A clean credit history with no recent bankruptcies, foreclosures, or significant derogatory marks is crucial. Fundwise, like other lenders, seeks reliability in repayment.

- Payment History: Consistent on-time payments across all your credit accounts (personal and any existing business accounts) are vital. This demonstrates responsible financial management.

- Credit Utilization: Keeping your credit card utilization low (ideally below 30%) on personal and business accounts signals that you are not over-reliant on credit.

- Number of Inquiries: While a few inquiries are normal, a high number of recent hard inquiries can temporarily lower your score and suggest financial distress.

It’s important to note that while your personal credit score is a key initial factor, Fundwise also considers other aspects, especially as you progress through their process. They aim to help you secure funding that often reports to business credit bureaus, which can help build your business’s own credit profile independently of your personal score over time.

The Fundwise Funding Process: Step-by-Step

Fundwise Capital streamlines the funding application process, making it significantly faster and less burdensome than traditional bank loans. Here’s a general overview of their process:

- Initial Application: You start by filling out a simple online application on the Fundwise website. This typically includes basic information about you and your business.

- Consultation & Assessment: A Fundwise funding specialist will typically reach out to discuss your business’s specific needs, assess your credit profile, and determine the best funding options available to you. This is where your personal Fundwise credit score will be evaluated.

- Funding Strategy & Approval: Based on the assessment, Fundwise will present a tailored funding strategy, often involving a combination of business credit cards and lines of credit. Once you approve the strategy, they help facilitate the applications with various lenders.

- Access to Funds: Upon approval from the various lenders, funds are typically available within 1-3 weeks. This can be significantly faster than many traditional business loan processes.

Their strength lies in connecting you with multiple funding sources, effectively acting as a broker that understands the nuances of unsecured lending for businesses.

Types of Funding Offered by Fundwise Capital

Fundwise primarily focuses on helping businesses secure unsecured funding, which means you typically don’t need to pledge assets as collateral. Their core offerings include:

- Unsecured Business Lines of Credit: These provide flexible access to capital that you can draw upon as needed and repay, then draw again. This is excellent for managing cash flow, covering unexpected expenses, or seizing immediate opportunities. Fundwise can help businesses qualify for up to $150,000 or more in unsecured credit lines.

- Business Credit Cards with 0% Intro APR: Fundwise leverages their relationships to help you get approved for business credit cards that offer introductory periods of 0% interest. This means you can use the capital for business operations without incurring interest charges for several months, effectively providing “free” capital during the intro period.

- Term Loans (Select Cases): While their primary focus is on credit lines and cards, in some cases, Fundwise may also assist with securing small, unsecured term loans, depending on the business’s profile and needs.

The beauty of these funding types is their flexibility. You can use the capital for almost any business purpose, from inventory and marketing to payroll and expansion, without strict limitations often found in traditional loans.

How to Prepare to Qualify for Fundwise Funding

To give yourself the best chance of meeting the Fundwise credit score requirements and overall eligibility, consider these preparatory steps:

- Check Your Personal Credit Score: Before applying, get a copy of your personal credit report from all three major bureaus (Experian, Equifax, TransUnion). Look for any errors and dispute them immediately. Aim for a FICO score of 680+ for better chances.

- Reduce Personal Credit Utilization: Pay down high balances on your personal credit cards. Lowering your utilization rate can quickly boost your credit score.

- Ensure Clean Personal Credit History: Address any past-due accounts or collections. Even small outstanding debts can be red flags for lenders.

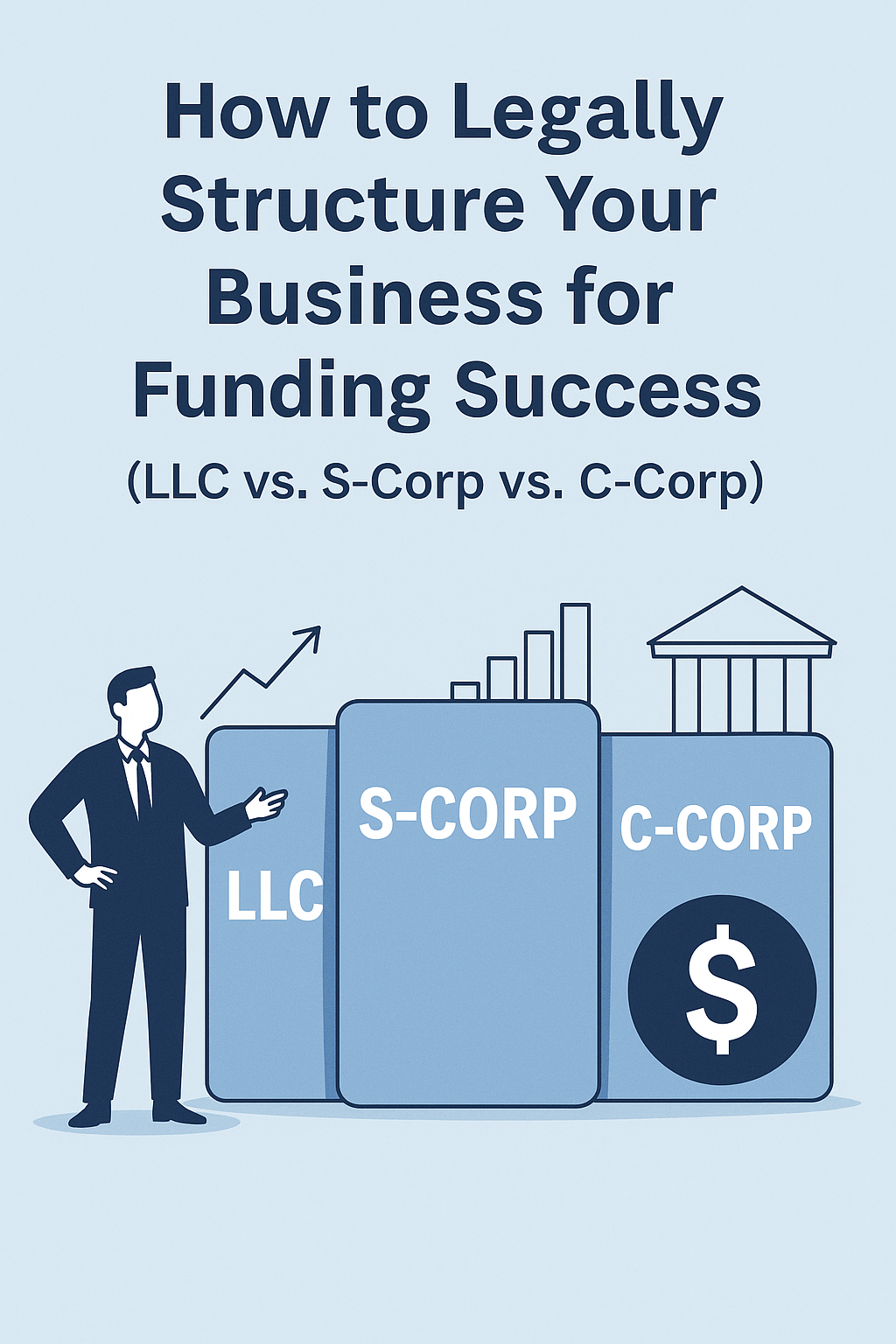

- Establish a Business Entity: If you haven’t already, formally register your business as an LLC, S-Corp, or C-Corp. This separation is crucial for building business credit and looks more professional to lenders. Read our guide: How to Structure Your Business for Funding Success.

- Obtain an EIN: An Employer Identification Number (EIN) is like a social security number for your business and is necessary for opening business bank accounts and applying for business credit.

- Open a Dedicated Business Bank Account: Keep your personal and business finances strictly separate. Lenders will want to see consistent revenue flowing through a business account.

- Maintain Consistent Business Revenue: While Fundwise often focuses on credit scores, having consistent revenue (even if not explicitly a minimum for their unsecured products) always strengthens your application.

Prequalify for Unsecured Funding with Fundwise Capital

Get quick access to unsecured business funding without the hassle. Fundwise Capital helps you prequalify for up to $150,000 in capital based on a blend of your personal and business credit, making funding simpler and faster.

- ✅ Prequalify in Minutes

- ✅ Up to $150,000 in Unsecured Funding

- ✅ No Collateral Required for Unsecured Options

- ✅ Streamlined Application Process

- ✅ Solutions for Various Business Stages

See how much funding your business can get prequalified for today!

Ready to Explore Fundwise Capital?

If you’re a founder looking for unsecured business funding and believe you meet the general Fundwise credit score expectations, Fundwise Capital offers a compelling alternative to traditional lending. Their focus on speed, flexibility, and leveraging business credit makes them an invaluable partner for growth-oriented businesses.

Don’t let rigid bank requirements hold your business back. Explore the potential of unsecured funding and take control of your growth trajectory.

Get Started with Fundwise Capital Today and See What You Qualify For!