In a world where lenders scrutinize every digit of your credit report, getting approved for a business loan with bad credit might seem impossible.

But here’s the truth: you can get funded business loans with bad credit — even with a suboptimal score — if you know where to look, what to prepare, and how to position your business.

This post breaks down your real options in 2025, from non-traditional lenders to credit repair strategies and funding tools that work even with a challenged credit profile.

Introduction: Why Bad Credit Doesn’t Mean “No” in 2025

Running a business with less-than-perfect credit used to mean long waits, rejected applications, or signing personal guarantees that made you lose sleep. Not anymore.

Modern funding platforms, fintech lenders, and alternative loan providers are rewriting the rules.

In this post, we’ll help you:

- Understand why credit scores matter (and when they don’t)

- Find real lenders who say “yes” even under 600 FICO

- Learn how to strengthen your approval odds

- Compare funding options like National Funding, FundWise, and Fund&Grow

- Discover how to leverage business credit instead of personal credit

Who Can Still Get Funded in 2025?

- Side hustlers with strong revenue

- Founders with previous credit issues but real traction

- Businesses with clean bank statements

- Owners who understand the game and apply smart

Avoid Common Mistakes

Mistake 1: Applying to Too Many Lenders

This triggers credit inquiries and lowers your score. Work with platforms like Fund&Grow that apply strategically.

Mistake 2: Using Personal Loans for Business

Separate your business and personal credit. Use real business funding tools — they build business credit.

Mistake 3: Waiting Until You’re Desperate

Apply when you still have runway. You’ll get better terms and options.

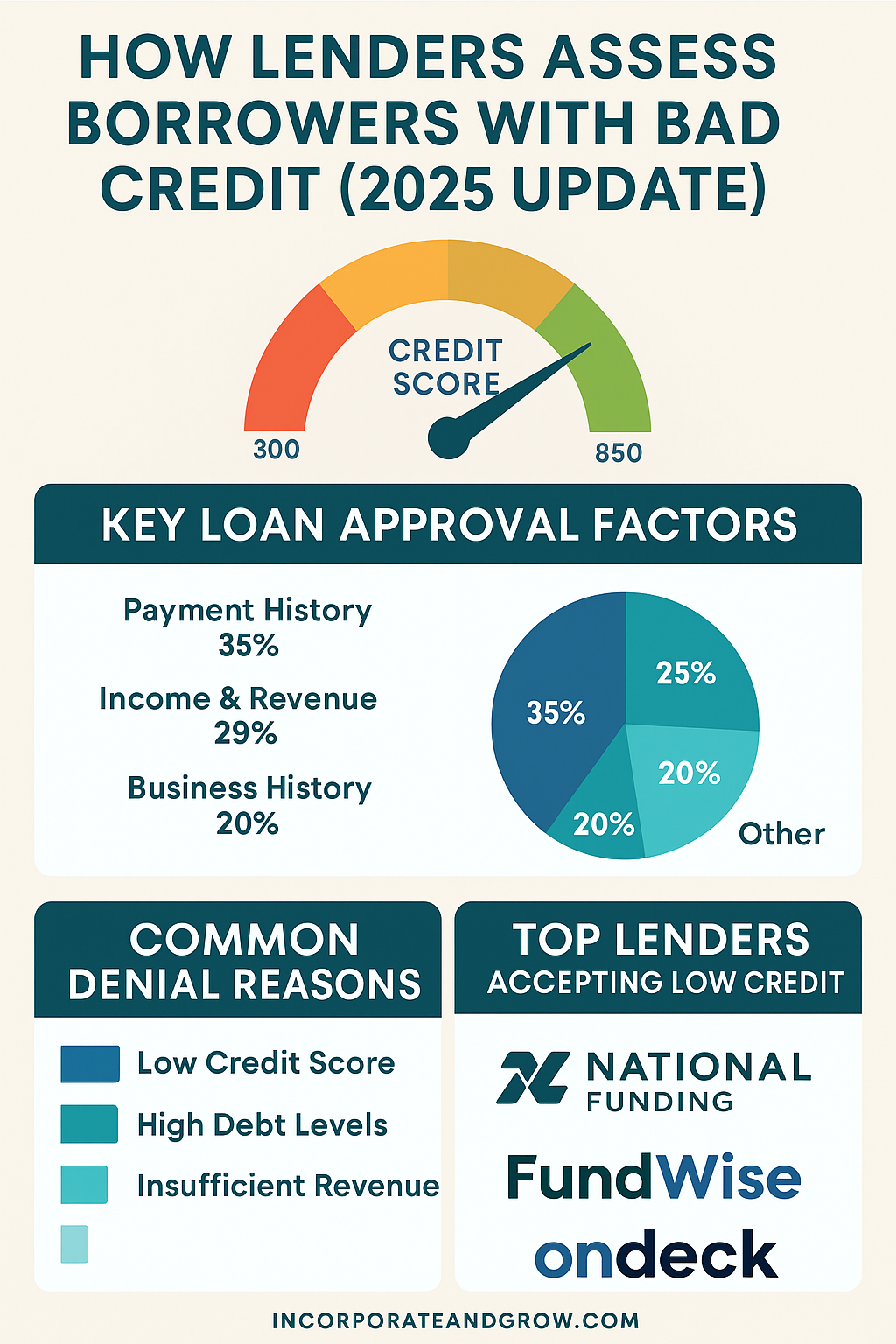

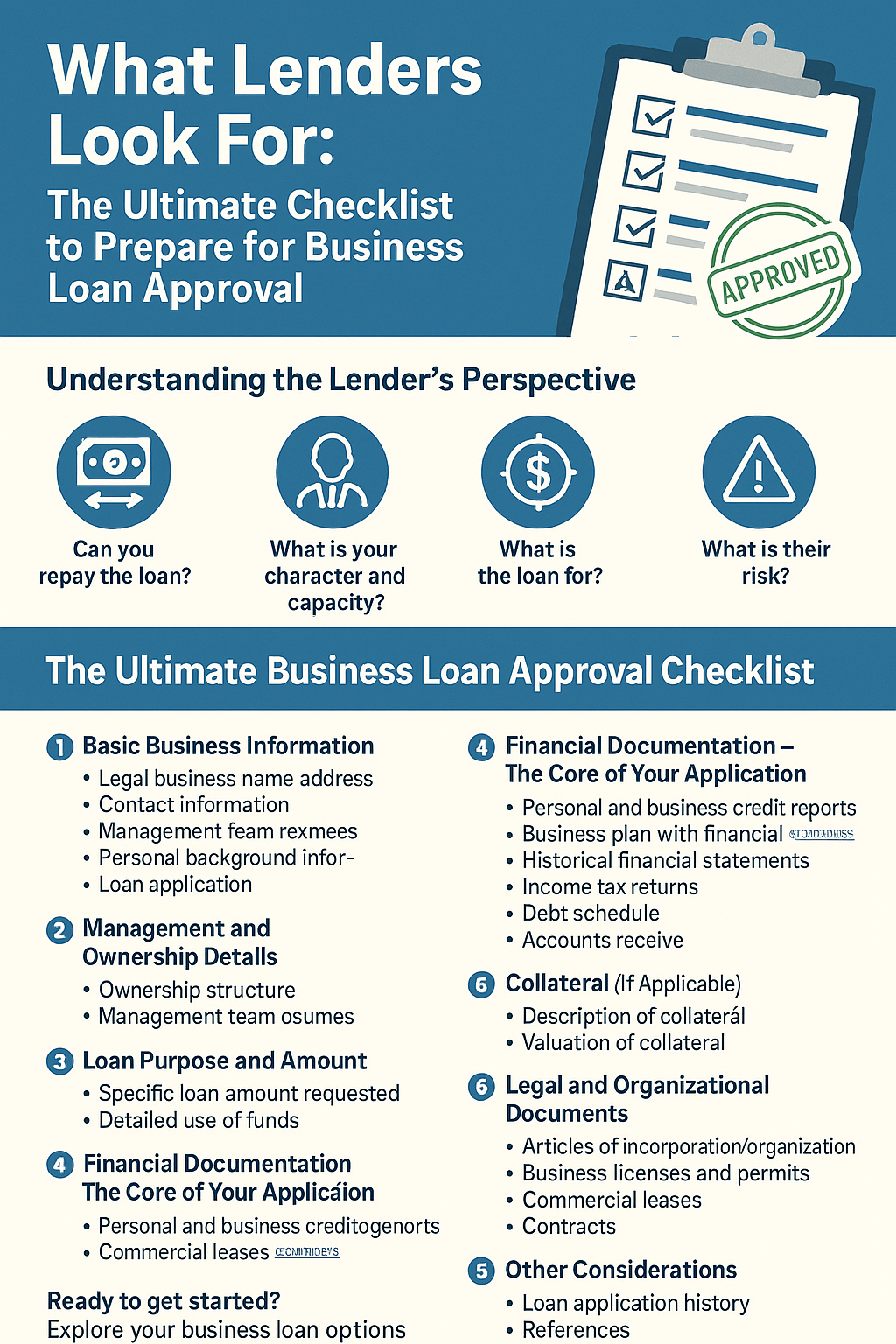

1. What Lenders Look for in 2025 (Even If Your Credit is Bad)

Not all bad credit is the same. In fact, most lenders in 2025 look at much more than just your score.

Here’s what they evaluate:

- Time in Business (TIB): Most lenders want 6+ months of operations

- Monthly Revenue: Strong cash flow can outweigh poor credit

- Business Bank Statements: Clean deposits, few overdrafts, and consistent income

- Entity Type: LLCs and Corporations are more lendable than Sole Props

- Use of Funds: Lenders want to know how you’ll use and repay the capital

Pro Tip: Want to look more credible on paper? Register your LLC with Northwest Registered Agent and clean up your business banking before you apply.

While FICO scores range from 300–850, here’s how lenders typically view personal credit:

- 750+ Excellent

- 700–749 Good

- 650–699 Fair

- 600–649 Poor

- Below 600 High Risk

If you’re under 650, you’re likely outside the approval window for traditional bank loans or SBA funding. But modern fintech lenders like National Funding and Fund&Grow have programs that work even at 600 — or with no personal guarantee at all.

2. Top Lenders That Work With Bad Credit (Including Our Partners)

National Funding: Fast Business Loans with Minimal Paperwork

If your business brings in at least $250K/year and has 6+ months of activity, National Funding is one of the fastest approvals you’ll find.

- Up to $500K in 24 hours

- Just 4 months of bank statements needed

- 600+ FICO minimum

- No collateral or extensive docs required

Apply Here: Incorporate & Grow – National Funding Partner

FundWise Capital: Perfect for Founders with Fair Credit

FundWise helps startups and entrepreneurs get unsecured capital up to $150K, even with average credit.

- 0% interest for the first 12–18 months

- No collateral

- Funding based on income and profile

Apply now: Fundwise Capital

Fund & Grow: Build Business Credit Even If Yours Is Bad

Instead of relying on personal credit, Fund & Grow helps you shift to a business credit model, starting with up to $250K in revolving lines.

- No PG required

- Includes entity optimization (they’ll help set up LLC or Corp)

- Full credit coaching & done-for-you service

3. Approval Boosters: How to Look More “Lendable”

a) Separate Personal and Business Finances

If you’re still mixing money, lenders will see you as a hobby, not a business.

Get pro-level bookkeeping with Bench and stay ready for tax season and funding opportunities.

b) Use Accounting Tools Lenders Respect

Accounting platforms like Xero make you look more legitimate and organized. Integrate with banks and payroll for real-time snapshots of cash flow.

c) Build a Business Credit Profile

Register your business with Dun & Bradstreet, get a D-U-N-S number, and start building vendor credit lines.

4. Realistic Funding Expectations with Bad Credit

Let’s get real — you’re not going to walk into Chase and walk out with a $250K check if you have a 580 credit score.

But here’s what you can realistically expect:

| Loan Type | Amount | Speed | Approval Odds |

|---|---|---|---|

| National Funding | $5K–$500K | 24–48 hrs | High if TIB & revenue OK |

| FundWise | $10K–$150K | 2–5 days | Medium-High |

| Fund & Grow | $50K–$250K (cards) | 7–21 days | Medium |

| SBA or Banks | $50K+ | 2–4 weeks | Low (bad credit denied) |

Source: SBA.gov, NerdWallet Small Business Loan Guide, Investopedia

5. Should You Fix Credit First or Apply Now?

Both.

You can often start building credit while also applying for immediate capital. Fund & Grow and National Funding help with both — one builds long-term financial firepower, the other delivers urgent cash.

Want to repair credit? [Check out our upcoming guide on Credit Repair Tools for Entrepreneurs — coming soon.]

6. Internal Resources to Help You Move Forward

- Compare Business Credit vs. Loans →

- See All Our Funding Tools in One Guide →

- LLC vs Sole Proprietorship — Which Is Better for Funding? →

Conclusion: Yes, You Can Get Funded

Bad credit doesn’t mean you’re unworthy of capital. It means you have to be strategic, selective, and prepared.

With partners like National Funding, FundWise, and Fund & Grow — plus smart tools like Bench and Xero — you can get the money you need without shame, delay, or debt traps.