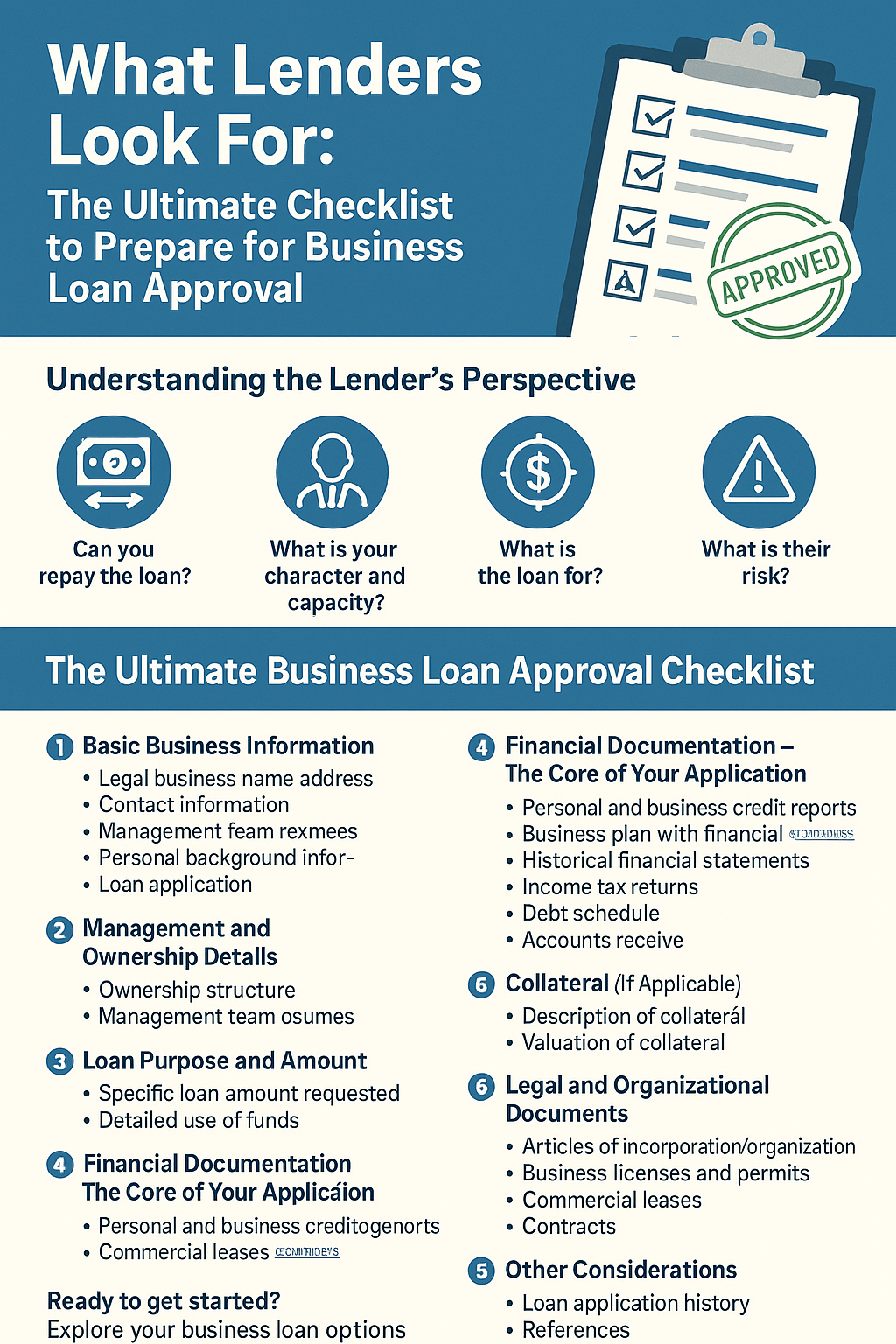

What Lenders Look For: The Ultimate Checklist to Prepare for Business Loan Approval

Securing a business loan approval is a crucial step for many startups and growing companies. However, walking into a bank or applying online without proper preparation is a recipe for rejection. Lenders aren’t just giving away money; they’re carefully assessing risk and looking for businesses that demonstrate a high likelihood of repayment. This article provides the ultimate checklist to ensure you’re putting your best foot forward and significantly increasing your chances of loan approval.

Understanding the Lender’s Perspective

Before diving into the checklist, it’s essential to understand why lenders ask for what they do. They want to answer a few fundamental questions:

- Can you repay the loan? This is the most critical factor. Lenders need to see a clear path to repayment, backed by solid financials and projections.

- What is your character and capacity? Lenders want to know they are dealing with responsible business owners who understand their industry and have the experience to succeed.

- What is the loan for? A clear, well-defined purpose for the loan demonstrates planning and responsible use of funds.

- What is their risk? Lenders minimize risk by assessing collateral, creditworthiness, and the overall health and stability of your business.

The Ultimate Business Loan Approval Checklist

This comprehensive checklist covers everything you need to gather and prepare before you even begin the loan application process.

1. Basic Business Information

- Legal Business Name: Ensure this matches all official documentation.

- Business Address: Include physical and mailing addresses.

- Contact Information: Phone number, email address, website.

- Business Structure: (LLC, S-Corp, C-Corp, etc.). Your business structure impacts funding options. See IncorporateAndGrow.com’s guide on business structure for more information.

- Date Established: How long has your business been operating?

- Employer Identification Number (EIN): Your business’s tax ID.

- Business Licenses and Permits: Ensure all are current and valid.

- Loan Application Form: Complete this accurately and thoroughly.

2. Management and Ownership Details

- Ownership Structure: List all owners, their names, addresses, and percentage of ownership.

- Management Team: Provide resumes of key personnel, highlighting relevant experience. Lenders want to see experienced leadership.

- Personal Background Information: Be prepared to provide previous addresses, names used, and potentially criminal record information for owners.

3. Loan Purpose and Amount

- Specific Loan Amount Requested: Be precise.

- Detailed Use of Funds: How will the loan be used? (e.g., equipment purchase, working capital, marketing, debt refinancing). Be specific and demonstrate how the loan will generate revenue.

- Repayment Plan: Outline how you intend to repay the loan. Be realistic and detailed.

4. Financial Documentation – The Core of Your Application

- Personal and Business Credit Reports: Obtain these before applying to correct any errors. A good personal credit score (670+) and a strong business credit profile are essential. Fundwise Capital specializes in helping businesses build strong credit.

- Business Plan: A well-structured plan is crucial, especially for startups. It should include:

- Executive Summary

- Company Description

- Market Analysis

- Management Team Overview

- Financial Projections (see below)

- Funding Request

- Financial Projections: Include realistic projections for at least the next 3-5 years:

- Projected Income Statements (Profit & Loss)

- Projected Cash Flow Statements

- Projected Balance Sheets

- Historical Financial Statements: Provide records for the past 3-5 years (if available):

- Income Statements (Profit & Loss)

- Balance Sheets

- Cash Flow Statements

- Income Tax Returns: Provide both personal and business tax returns for the past 3 years. (Source: IRS.gov)

- Bank Statements: Provide at least 6-12 months of business bank statements.

- Debt Schedule: If your business has existing debt, provide a schedule outlining those obligations.

- Accounts Receivable and Payable: Details of your current financial position, including aging reports.

![[WordPress will pull existing title text] [WordPress will pull existing alt text]](https://incorporateandgrow.com/wp-content/uploads/2025/05/file_00000000dd0861f7a21f2baf06f26e79.png)

5. Collateral (If Applicable)

- Description of Collateral: If the loan is secured, provide a detailed list of assets being offered as collateral (e.g., real estate, equipment, inventory).

- Valuation of Collateral: Include appraisals or other documentation to support the value of the collateral.

6. Legal and Organizational Documents

- Articles of Incorporation/Organization: Proof of your business’s legal formation.

- Business Licenses and Permits: Copies of all relevant licenses and permits.

- Commercial Leases: If you lease property, provide a copy of the lease agreement.

- Contracts: Copies of significant contracts (e.g., with major clients or suppliers).

7. The “Five C’s” of Credit

Lenders often evaluate loan applications based on the “Five C’s” (Source: Investopedia):

- Character: Your experience, education, and personal/business credit history.

- Capacity: Your ability to repay the loan, based on cash flow and financial projections.

- Capital: The amount of your own investment in the business.

- Collateral: Assets you pledge to secure the loan.

- Conditions: The overall economic and industry conditions.

![[WordPress will pull existing title text] [WordPress will pull existing alt text]](https://incorporateandgrow.com/wp-content/uploads/2025/05/ChatGPT-Image-May-8-2025-02_18_45-PM.png)

8. SBA Loan Requirements (If Applicable)

If you’re applying for an SBA loan, be aware of additional requirements (Source: SBA.gov), including:

- SBA application forms

- Personal financial statements

- Documentation of how loan proceeds will be used.

- Businesses must operate for profit and be located in the U.S.

9. Other Considerations

- Loan Application History: Include records of any previous loan applications.

- References: Character references from respected community members or former employers can strengthen your application.

- Professional Resume: Provide a resume highlighting your business experience.

Where to Get Help

Preparing for a business loan can be complex. Consider these resources:

- SBA (Small Business Administration): Offers resources and guidance for small business loans.

- Your Bank/Lender: Relationship managers can provide valuable advice.

- Financial Advisors: Can help you prepare financial statements and projections.

- IncorporateAndGrow.com: Provides resources and information for business funding and structure.

Conclusion: Preparation is Key

By thoroughly preparing the documents and information outlined in this checklist, you’ll demonstrate to lenders that you are a serious, responsible borrower with a well-planned business. This significantly increases your chances of loan approval and helps you secure the funding you need to grow. Remember to prioritize building strong business credit; Fund & Grow can be an invaluable partner in this process. And for managing your finances effectively, consider tools like Xero Accounting or Bench Bookkeeping.

Ready to get started?

Explore your business loan options and apply with confidence. Apply now with National Funding for fast approvals and competitive rates!