How to Get a Business Loan in 24 Hours: Your Guide to Rapid Working Capital in 2025

When every second counts, knowing where to find **fast business funding** is critical.

As an ambitious founder or a growing small business owner, you know that opportunities (and challenges) don’t always wait. Whether it’s an unexpected equipment breakdown, a chance to buy discounted inventory, or an urgent marketing push, sometimes you need capital, and you need it **now.**

Traditional bank loans can be slow, cumbersome, and riddled with paperwork. So, is it truly possible to get a business loan in 24 hours? The answer is often **yes**, for the right business with the right partner.

At **IncorporateAndGrow.com**, we understand the urgency. This guide cuts through the noise to show you exactly how **rapid working capital** can fuel your growth, outlining the solutions, **qualifications**, and the process to get you funded swiftly in 2025.

![[WordPress will pull existing title text] [WordPress will pull existing alt text]](https://incorporateandgrow.com/wp-content/uploads/2025/06/file_00000000ff90623095e418d97145c1d5-300x300.png)

The Urgent Need for Rapid Business Capital

Why would a business need funding so quickly?

- Seizing Opportunities: A sudden chance to buy bulk inventory at a discount, or invest in a limited-time marketing campaign.

- Bridging Cash Flow Gaps: Waiting for invoices to be paid, seasonal dips, or unexpected revenue delays.

- Emergency Expenses: Equipment repairs, facility damage, or other unforeseen costs that impact operations.

- Making Payroll: Ensuring your team is paid on time, even during unforeseen dips in revenue.

For these scenarios, waiting weeks or months for a traditional loan simply isn’t an option. That’s where **rapid funding solutions** shine.

Is a “24-Hour Business Loan” Really Possible?

The term “24-hour business loan” refers to the speed of approval and, more importantly, the speed of disbursement. While some niche lenders might process a full application and fund within 24 business hours, it more commonly means you can get:

- **Rapid Pre-Qualification:** Often within minutes or hours.

- **Fast Approval:** Typically within 1-3 business days.

- **Swift Funding:** Funds deposited into your account within 1-2 business days after approval.

The key difference from traditional loans is the streamlined application, minimal documentation, and reliance on bank statements and business performance rather than extensive credit checks and collateral.

Meet National Funding: Your Path to Fast Working Capital

When speed and flexibility are paramount, **National Funding** stands out as a premier partner for business owners seeking rapid working capital. They specialize in getting established U.S. businesses the funds they need, often without the typical waiting game associated with conventional lending.

⚡ National Funding: Fast Business Loans with Minimal Paperwork

National Funding is engineered for efficiency, offering a fast track to capital for businesses with proven revenue. They understand that time is money, and their process reflects that urgency.

- **Funding from $10K to $500K:** Versatile amounts to meet various needs.

- **Funds in as Little as 24 Hours:** Their commitment to speed is unmatched for qualified businesses.

- **No Collateral Required:** A significant benefit, reducing risk and simplifying the process.

- **Minimal Requirements:**

- Only 6 months in business.

- $250K+ annual revenue.

- 600+ FICO personal credit score.

- **Quick Application:** Just 4 months of bank statements needed for assessment.

Perfect for: Established founders who need working capital fast and meet basic revenue and credit minimums. If your business has consistent cash flow and you’re ready to act, National Funding is often the quickest route to financing.

What You Need to Qualify for a Fast Business Loan (Essential Requirements)

Even with minimal paperwork, rapid lenders have key criteria to ensure you’re a good fit. Meeting these helps you secure approval even faster:

- **Time in Business:** Typically 6+ months to 1 year. National Funding, for example, requires only 6 months.

- **Minimum Annual Revenue:** Many fast lenders require a minimum, often $100K-$250K+ annually, reflecting your business’s ability to repay. (National Funding’s $250K+ is a common benchmark for fast, unsecured loans).

- **Personal Credit Score:** While not solely credit-driven, a decent personal FICO score (e.g., 600+) can significantly help.

- **Business Bank Statements:** Recent business bank statements (usually 3-6 months) are crucial for lenders to assess cash flow and stability. They look for consistent deposits and positive balances.

- **Legal Entity & Documents:** Ensure your business is legally registered (LLC, Corporation) and you have basic documents like an EIN. (Consider linking to your business structure or registered agent article here).

- **Personal Guarantee:** Most rapid business loans will require a personal guarantee from the business owner, meaning you are personally liable if the business defaults.

- **Clear Use of Funds:** Lenders want to know how the funds will be utilized for business purposes.

![[WordPress will pull existing title text] [WordPress will pull existing alt text]](https://incorporateandgrow.com/wp-content/uploads/2025/05/file_00000000558861f7ab8091e250a4ceaf.png)

Speeding Up Your Application with Organized Financials

The single best thing you can do to accelerate *any* loan application, especially a fast one, is to have your financials in impeccable order. Lenders like National Funding rely on quick access to clear data to make rapid decisions.

Expert Tip: Clean Books = Faster Funding!

Maintaining accurate and up-to-date financial records with professional tools like **Xero** or **Bench.co** isn’t just good practice—it’s a direct accelerator for loan applications. Automated bank feeds and categorized transactions mean you can instantly provide the clean bank statements and financial summaries lenders need for rapid approval.

- **For Seamless Accounting:** Try Xero — Get 90% Off for 6 Months

- **For Done-for-You Bookkeeping:** Get Started with Bench Bookkeeping

Alternatives for Rapid Capital (Beyond the 24-Hour Loan)

While National Funding is a top choice for fast working capital, other partners can offer rapid access to funds depending on your specific needs or eligibility:

💳 Amex Business Credit & Loans: Quick Access to Credit Lines

If you’re looking for a flexible credit line rather than a lump-sum loan, American Express offers premium business credit cards and lending options. These can provide quick access to revolving credit for immediate expenses, often with 0% intro APR offers or robust rewards.

👉 Get Matched with the Right Amex Offer (Warm Intro)

💼 FundWise Capital: Unsecured Lines for Early-Stage Entrepreneurs

For earlier-stage businesses or those with limited business credit history, **FundWise Capital** specializes in helping secure unsecured lines of credit. If you have decent personal credit, you could access up to $150K in unsecured funding, often pre-qualified quickly.

✅ Apply for Startup Funding with FundWise

🚀 Fund&Grow: Convert Personal Credit into 0% Business Funding

Looking for a strategic approach to secure up to $250K in 0% interest business credit, even for newer businesses? **Fund&Grow** offers a proven system to leverage personal credit into business funding, effectively separating your finances over time.

🚀 Learn About Building 0% Business Credit with Fund&Grow Webinar

The Application Process: What to Expect for Fast Loans

The beauty of rapid funding solutions is their streamlined process. Here’s a typical flow:

- **Online Application:** Fill out a quick form with basic business and personal details.

- **Connect Bank Accounts:** Securely link your business bank account (or upload statements) for rapid financial review. This is where clean books truly shine!

- **Rapid Decision:** Lenders like National Funding often provide a decision within hours or a day.

- **Review Offer:** If approved, review the terms, rates, and repayment schedule carefully.

- **Receive Funds:** Once you accept the offer, funds are typically deposited directly into your business bank account within 1-2 business days (or even 24 hours for some like National Funding).

FAQs About 24-Hour Business Loans & Rapid Capital

Here are common questions founders ask about rapid funding options:

Are 24-hour business loans expensive?

Generally, faster loans come with **higher interest rates or fees** compared to long-term traditional bank loans. This is due to the higher risk associated with quick approvals and less stringent requirements. However, the cost can be justified by the urgency of your need and the opportunity the funds unlock.

What’s the difference between rapid capital and a traditional bank loan?

Traditional bank loans are often secured, require extensive documentation, have strict credit criteria, and take weeks or months to process. Rapid loans from alternative lenders are typically **unsecured**, require **minimal documentation**, focus on **cash flow and recent performance**, and fund significantly faster.

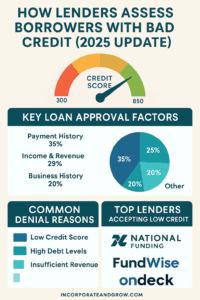

Can I get a 24-hour business loan with bad credit?

While a higher FICO score helps, some fast lenders are more flexible if you have strong revenue and consistent cash flow. Your best bet is to explore options specifically designed for varying credit profiles. For more in-depth information, read our guide: How to Get Business Loans with Bad Credit in 2025.

What are the repayment terms for rapid business loans?

Repayment terms vary. Fast working capital loans often have **shorter repayment periods** (e.g., 6-18 months) and may involve **daily or weekly deductions** from your bank account, aligning with your cash flow to ensure consistent payments.

Conclusion: Fueling Your Business Growth, Fast

In the dynamic world of entrepreneurship, having immediate access to capital can be the difference between seizing a golden opportunity and missing out. While traditional lending has its place, solutions like those offered by **National Funding** provide the speed and flexibility modern businesses demand.

By understanding what’s available and having your financial house in order with tools like **Xero** and **Bench.co**, you can confidently navigate urgent cash flow needs and ensure your business never misses a beat.

Ready to unlock rapid working capital for your business?