Small Business Bookkeeping & Payroll Made Easy (2025 Guide to Financial Tools for Founders)

The thrill of launching a startup, securing funding, and bringing your vision to life is undeniable. You’re likely an expert in your product, your market, or your service. But what about the less glamorous, yet absolutely critical, world of small business bookkeeping and payroll? For many founders, it feels like navigating a dense jungle without a map — confusing, time-consuming, and fraught with potential pitfalls.

Yet, ignoring your financial health is like building a skyscraper on a foundation of sand. In 2025’s dynamic economy, transparent and efficient financial operations aren’t just a compliance burden; they’re a strategic superpower. They empower you to make informed decisions, attract future investment, stay compliant with regulations, and ultimately, scale your business sustainably.

This comprehensive guide is your map. We’ll demystify small business bookkeeping and payroll, explore the best tools and services available in 2025, and show you how to leverage them for unwavering financial clarity and seamless operations. Whether you’re a lean startup just getting off the ground or scaling rapidly, understanding and implementing robust financial practices is non-negotiable for long-term success.

Table of Contents

- Why Bookkeeping & Payroll Are Your Business’s Backbone

- DIY Bookkeeping: Tools & Best Practices for the Hands-On Founder

- Outsourced Bookkeeping: When to Consider It (And Why Bench Stands Out)

- Mastering Payroll as a Small Business (And Why Gusto is the Go-To)

- Beyond the Basics: Leveraging Financial Tools for Growth

- Connecting Financial Health to Funding & Growth

- Choosing the Right Tools for Your Business

- Conclusion: Take Control of Your Financial Future

Why Bookkeeping & Payroll Are Your Business’s Backbone

Far beyond just tracking money, accurate bookkeeping and streamlined payroll directly impact your business’s viability and growth potential.

1. Compliance and Avoiding Penalties

The IRS, state tax authorities, and other regulatory bodies don’t care how busy you are innovating; they care about compliance. Proper bookkeeping ensures you have the records needed for accurate tax filings, preventing costly errors, audits, and hefty penalties. Payroll, with its complex web of withholdings, deductions, and reporting requirements, is an even more intricate dance where missteps can lead to severe fines and legal headaches. Getting it right from day one saves you immense stress and money down the line.

2. Crystal-Clear Financial Visibility

Imagine trying to navigate a ship through stormy seas without a compass or radar. That’s what running a business without accurate financial data feels like. Bookkeeping provides real-time insights into your cash flow, profitability, expenses, and revenue. This clarity allows you to:

- Identify spending trends.

- Pinpoint areas for cost reduction.

- Understand your profit margins.

- Forecast future performance.

- Make data-driven strategic decisions.

3. Investment Readiness and Attracting Capital

Whether you’re seeking angel, seed, or venture capital, or even exploring options like our guide to Business Funding Tools, investors will scrutinize your financials. Clean, organized books demonstrate financial maturity, mitigate risk, and instill confidence. You can’t just say your business is growing; you need to prove it with detailed financial statements. A well-managed payroll also signals operational professionalism.

4. Strategic Decision-Making and Growth Fuel

Your financial records are a goldmine of insights. Want to know if you can afford to hire more staff? Look at your payroll and cash flow. Debating a new marketing campaign? Analyze past ROI by tracking related expenses. Thinking about expanding into a new market? Your current financial health provides the foundation for such strategic moves. Bookkeeping and payroll are not just administrative tasks; they are powerful tools for charting your course to sustainable growth.

DIY Bookkeeping: Tools & Best Practices for the Hands-On Founder

For many early-stage founders, especially those who are bootstrapping or on a tight budget, managing their own books is the logical first step. It offers complete control and saves on outsourcing costs. However, it requires discipline and the right tools.

Pros of DIY Bookkeeping:

- Cost-Effective: Significantly cheaper than hiring an external bookkeeper.

- Full Control: You have direct access and understanding of every financial transaction.

- Learning Opportunity: Builds fundamental financial literacy for founders.

Cons of DIY Bookkeeping:

- Time-Consuming: Can divert precious time away from core business activities.

- Complexity: Can be challenging, especially as your business grows or if transactions are complex.

- Error Prone: Without expertise, mistakes can occur, leading to tax issues or inaccurate reporting.

Essential Tools for DIY Bookkeeping in 2025: Xero

When it comes to user-friendly yet powerful DIY accounting software, Xero stands out as a top contender for small businesses and startups in 2025.

Xero is a cloud-based accounting platform designed to simplify financial management. It’s particularly loved by founders for its intuitive interface and robust features.

Key Benefits for Founders using Xero:

- Automation: Automates bank reconciliation, invoicing, and expense tracking, reducing manual data entry.

- Cash Flow Insights: Provides real-time dashboards and reports, giving you immediate visibility into your financial health.

- Integration: Seamlessly integrates with hundreds of apps, including payment processors, CRM systems, and payroll solutions, creating a unified financial ecosystem.

- Mobile Access: Manage your books from anywhere, anytime, with their mobile app.

- Scalability: Grows with your business, offering various plans to suit your evolving needs.

Xero is ideal for founders who want a hands-on approach to their finances but need smart technology to streamline the process.

Best Practices for Managing Your Own Books:

- Separate Business & Personal Finances: This is Rule #1. Get a dedicated business bank account and credit card. This makes tracking expenses and income infinitely easier and protects your personal assets.

- Choose a Chart of Accounts: Understand the basic categories for your income and expenses. Xero and similar software provide templates, but customize them to fit your business.

- Record Transactions Regularly: Don’t let receipts pile up. Reconcile your bank accounts and categorize transactions weekly, or at least monthly. Consistency is key.

- Keep Digital Records: Scan and store all receipts and invoices digitally. Cloud-based accounting software often includes features for this.

- Understand Basic Financial Statements: Familiarize yourself with your Profit & Loss (Income) Statement and Balance Sheet. These tell the story of your business’s financial performance and health.

Outsourced Bookkeeping: When to Consider It (And Why Bench Stands Out)

As your business grows, so does the complexity of your financial transactions. What starts as a few invoices can quickly escalate into hundreds, along with multiple payment platforms, inventory management, and diverse revenue streams. At a certain point, your time might be better spent on core business development rather than reconciling accounts.

Pros of Outsourced Bookkeeping:

- Time-Saving: Frees up significant founder time.

- Expertise: Access to professional bookkeepers who understand tax laws and best practices.

- Accuracy: Reduces the risk of errors that could lead to financial or legal issues.

- Scalability: Services can often scale with your business needs.

Cons of Outsourced Bookkeeping:

- Cost: More expensive than DIY software alone.

- Less Direct Control: You’re relying on a third party, requiring good communication.

When to Consider Outsourcing:

- Your Time is Priceless: If you’re spending more than 5-10 hours a week on bookkeeping, it’s time to evaluate.

- Growing Complexity: Multiple revenue streams, inventory, international transactions, or a growing team.

- Seeking Investment: Clean, professionally managed books impress investors.

- Tax Season Stress: If tax time is a nightmare, an outsourced bookkeeper can prepare you for filings.

Essential Tools for Outsourced Bookkeeping in 2025: Bench

For founders who are ready to offload the burden of bookkeeping to experts, Bench.co offers a compelling solution. Bench provides professional bookkeepers who handle your monthly financials, backed by intuitive software.

Key Benefits for Founders using Bench:

- Dedicated Team: You get a dedicated bookkeeping team who learns your business.

- Seamless Integration: Syncs with your bank accounts and credit cards to automatically pull transaction data.

- Monthly Financials: Receive clear, categorized financial statements (income statement, balance sheet) every month.

- Tax Ready Books: Your books are prepared and organized, making tax time significantly easier. Bench also offers tax filing services.

- Human Support: Unlike pure software, you have human experts to answer your questions and provide insights.

Bench is perfect for founders who want peace of mind, accurate financials without the hands-on effort, and expert support.

Mastering Payroll as a Small Business (And Why Gusto is the Go-To)

Payroll isn’t just cutting checks; it’s a complex administrative process involving calculations for wages, withholdings, taxes (federal, state, local), benefits deductions, and compliance with ever-changing labor laws. Even for one employee (or just yourself as the founder), getting payroll wrong can lead to serious legal and financial repercussions.

The Complexities of Payroll:

- Tax Compliance: Income tax, FICA (Social Security and Medicare), unemployment taxes (FUTA, SUTA) – all with different rates and reporting deadlines.

- Deductions: Health insurance premiums, retirement contributions, garnishments.

- Benefits Administration: Managing health plans, 401(k)s, PTO.

- New Hire Reporting: State-specific requirements for new employees.

- Year-End Filings: W-2s, 1099s, quarterly reports.

Essential Tools for Payroll in 2025: Gusto

For small businesses and startups looking for a comprehensive, user-friendly payroll and HR solution, Gusto is a top recommendation in 2025. It simplifies the entire process, making it accessible even for first-time employers.

Key Benefits for Founders using Gusto:

- Full-Service Payroll: Automates payroll runs, calculates and files all federal, state, and local taxes, and sends payments directly to employees via direct deposit.

- Benefits Administration: Easily offer and administer health insurance, 401(k)s, commuter benefits, and more, all integrated seamlessly with payroll.

- HR Tools: Provides essential HR features like onboarding checklists, offer letters, employee directories, paid time off (PTO) tracking, and compliance resources.

- User-Friendly Interface: Designed with small business owners in mind, making complex tasks straightforward.

- Automated Compliance: Helps keep you compliant with payroll taxes and labor laws, minimizing risks.

- Time Tracking Integration: Integrates with popular time tracking software to streamline hours calculation for payroll.

Gusto is the ideal partner for founders who need to manage their team’s compensation and benefits efficiently, compliantly, and with minimal fuss.

Simplify your payroll, benefits, and HR. Get started with Gusto and put your team on autopilot!

Beyond the Basics: Leveraging Financial Tools for Growth

Your financial operations are not just about compliance; they’re about strategic advantage. By integrating your bookkeeping and payroll with other crucial business functions, you can optimize cash flow, maintain compliance, and prepare for future growth.

Optimizing Cash Flow with Business Credit & Amex

Managing the flow of money in and out of your business is paramount. Payroll, in particular, can create significant outflows. Leveraging business credit effectively can help bridge gaps and optimize your working capital.

- Business Credit Cards: Strategic use of business credit cards, like those offered by Amex, can provide flexibility for managing short-term cash flow, especially around payroll cycles or unexpected expenses. Many offer rewards and beneficial payment terms.

- Revolving Credit: Having access to a line of credit means you can draw funds when needed and repay as cash comes in, providing a buffer.

Consider exploring options like the Amex Offer page to find tailored solutions that can help streamline your payments and enhance your business’s financial agility.

Ensuring Compliance with Proper Business Structure & Registered Agents

Before you even think about payroll, your business needs a solid legal foundation. The type of business structure you choose (LLC, S-Corp, C-Corp, Sole Proprietorship) has profound implications for your taxes, liability, and even how you manage payroll.

For a deeper dive into choosing the right structure, refer to our guide: Business Structure for Funding.

Once you’ve chosen your structure, especially for LLCs or Corporations, you’ll need a Registered Agent. This is a legal requirement in every state, providing a physical address for legal and tax correspondence. Missing this step can lead to penalties and even the dissolution of your business.

Northwest Registered Agent is a trusted provider of registered agent services, ensuring you meet compliance requirements from the outset. They offer essential services beyond just an address, including mail forwarding and pre-filled forms, making setup easy.

Seamless Integration for Holistic Financial Management

The beauty of modern financial tools is their ability to integrate. Your bookkeeping software (like Xero) can often link directly with your payroll service (like Gusto), your business bank accounts, and even your credit cards. This creates a unified financial picture, minimizing manual data entry and ensuring data consistency.

Connecting Financial Health to Funding & Growth

The ultimate goal of meticulous bookkeeping and efficient payroll is to support your business’s growth. Strong financial records are not just for reporting; they are powerful assets in your pursuit of further capital.

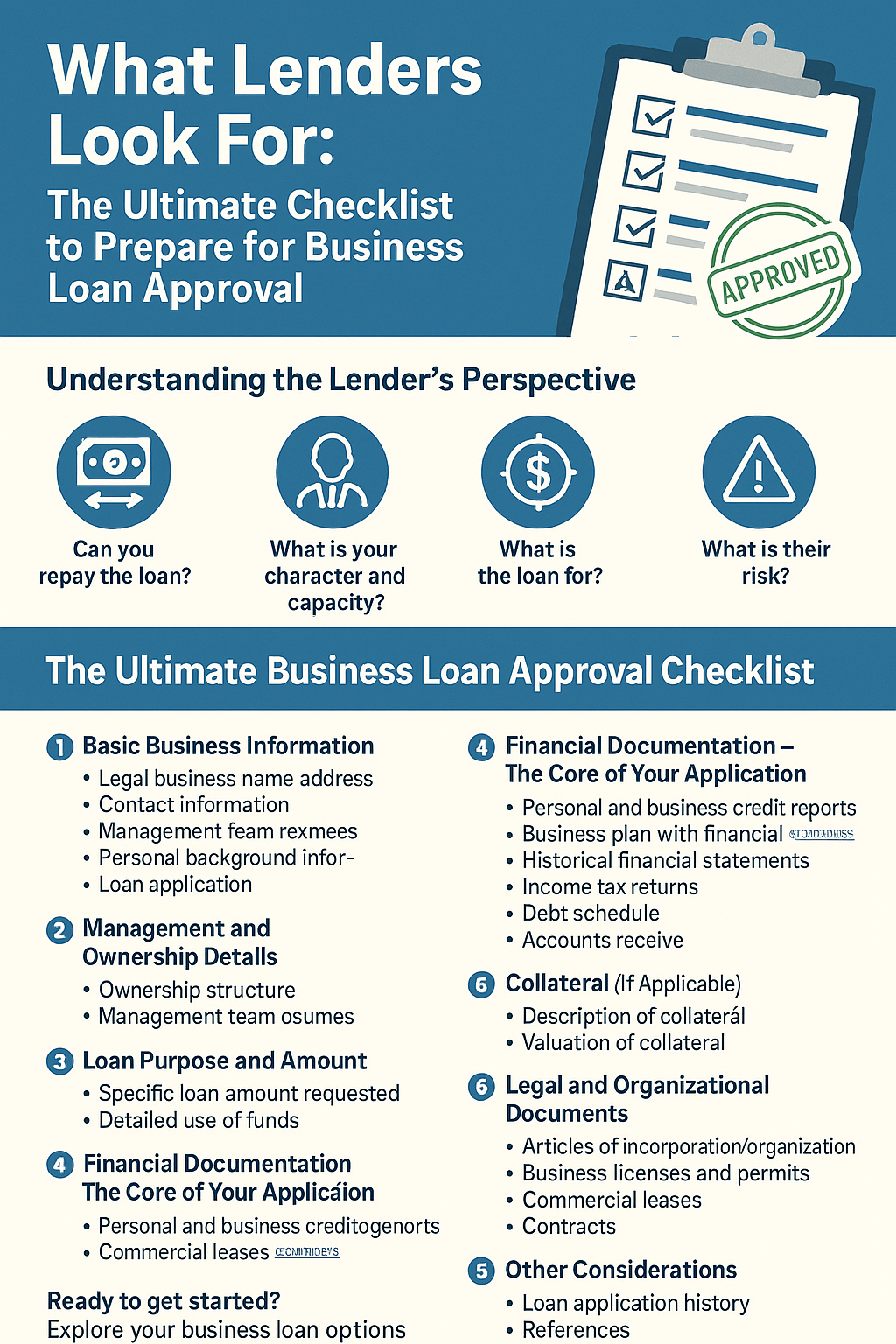

- Accelerate Loan Approvals: Lenders demand clear financial statements. When you have well-maintained books, the process of applying for a business loan becomes significantly smoother and faster. It demonstrates your fiscal responsibility. Learn more about what lenders look for in our Loan Approval Checklist.

- Qualify for Rapid Capital: Businesses with organized financials and predictable cash flow are better positioned to secure swift funding, like the 24-Hour Loans often needed for urgent working capital. Transparency in your financial data helps lenders assess risk quickly.

- Strategic Growth Decisions: With real-time financial insights, you can confidently invest in growth initiatives, expand your team, or pursue new market opportunities. You’ll know your true financial capacity.

- The Founder’s Toolkit: Bookkeeping and payroll tools are integral components of the broader suite of resources that enable a founder’s journey. They directly contribute to the financial health you need to leverage other Business Funding Tools.

Choosing the Right Tools for Your Business

Deciding between DIY bookkeeping, outsourced services, and the various payroll solutions depends on your unique needs, budget, and comfort level with financial management.

| Feature | DIY Bookkeeping (e.g., Xero) | Outsourced Bookkeeping (e.g., Bench) | Full-Service Payroll (e.g., Gusto) |

|---|---|---|---|

| Control | High | Moderate to High | High (via intuitive dashboard) |

| Time Commitment | High | Low | Low to Moderate (initial setup, ongoing employee management) |

| Cost | Lowest (monthly software fee) | Moderate (monthly service fee) | Moderate (per employee/month fee) |

| Expertise Req. | Basic financial understanding; willingness to learn | None required on your part; relies on provider’s expertise | Minimal; software handles complexities |

| Ideal For | Solo founders, very small businesses, budget-conscious | Growing businesses, founders short on time, those seeking expert help | Any business with employees (even just the founder as employee) |

| Key Benefit | Financial insight, cost savings | Accuracy, time savings, expert support | Compliance, automation, comprehensive HR |

Factors to Consider:

- Your Budget: Clearly define what you can afford for software and/or services.

- Your Time: How much time are you willing to dedicate to financial admin each week?

- Your Expertise: Are you comfortable navigating financial statements and tax requirements, or would you prefer to delegate?

- Business Complexity: How many transactions do you have? Do you manage inventory, multiple locations, or diverse revenue streams?

- Growth Projections: Choose solutions that can scale with your business without needing to switch every year.

Conclusion: Take Control of Your Financial Future

As a founder, your journey is filled with innovation, challenges, and incredible opportunities. Don’t let financial management be a roadblock. By embracing the right small business bookkeeping and payroll tools in 2025, you’re not just ensuring compliance; you’re gaining profound clarity, making smarter decisions, and building a more resilient, attractive business for future investment and sustained growth.

Whether you choose a DIY approach with robust software like Xero, opt for the expert support of Bench, or streamline your team’s compensation with Gusto, taking proactive steps in your financial operations is the hallmark of a smart founder. Start today, and secure your business’s financial future.

Frequently Asked Questions (FAQs)

- Q: When should a small business start doing formal bookkeeping?

A: Ideally, from day one. Even before your first sale, tracking startup costs is crucial for tax purposes and understanding your initial investment. - Q: Do I need separate bank accounts for my business?

A: Absolutely. Separating personal and business finances is fundamental for accurate bookkeeping, tax compliance, and liability protection. - Q: How often should I update my bookkeeping?

A: For most small businesses, weekly or at least monthly reconciliation is recommended to ensure accuracy and timely insights. - Q: Can I do payroll myself without software?

A: While technically possible for very few employees, it is highly complex due to tax calculations, withholdings, and reporting requirements. Payroll software significantly reduces errors and ensures compliance. - Q: What’s the main difference between bookkeeping and accounting?

A: Bookkeeping is the systematic recording of financial transactions (the day-to-day data entry). Accounting is the broader process of interpreting, classifying, analyzing, verifying, and reporting that data to provide financial insights. Bookkeeping is a part of accounting.

Disclaimer: This article contains affiliate links. If you make a purchase through these links, Incorporate and Grow may earn a commission at no extra cost to you. This helps support our content and recommendations.