Business Credit vs Business Loans: Which Fuels Faster Growth?

As a founder, one of the biggest decisions you’ll make early in your business journey is how to fund your growth. Should you apply for a traditional business loan, or is building business credit a smarter, more flexible path? Understanding the differences between business credit vs business loans is crucial for strategic financial planning. This article breaks down both funding options so you can make an informed, strategic decision for your business’s accelerated growth. Whether you’re launching a startup, growing a consulting agency, scaling an e-commerce brand, or building a real estate portfolio — understanding the pros and cons of credit vs. loans will empower your next move and help you fuel faster growth. Ready to dive deep and find the right funding path for your venture? Jump to our head-to-head comparison table.

Spoiler Alert: There’s no one-size-fits-all solution. However, if you’re a new founder without deep pockets or perfect personal credit, building strong business credit could fuel your growth — faster and with fewer strings attached than traditional loans.

Let’s compare the two.

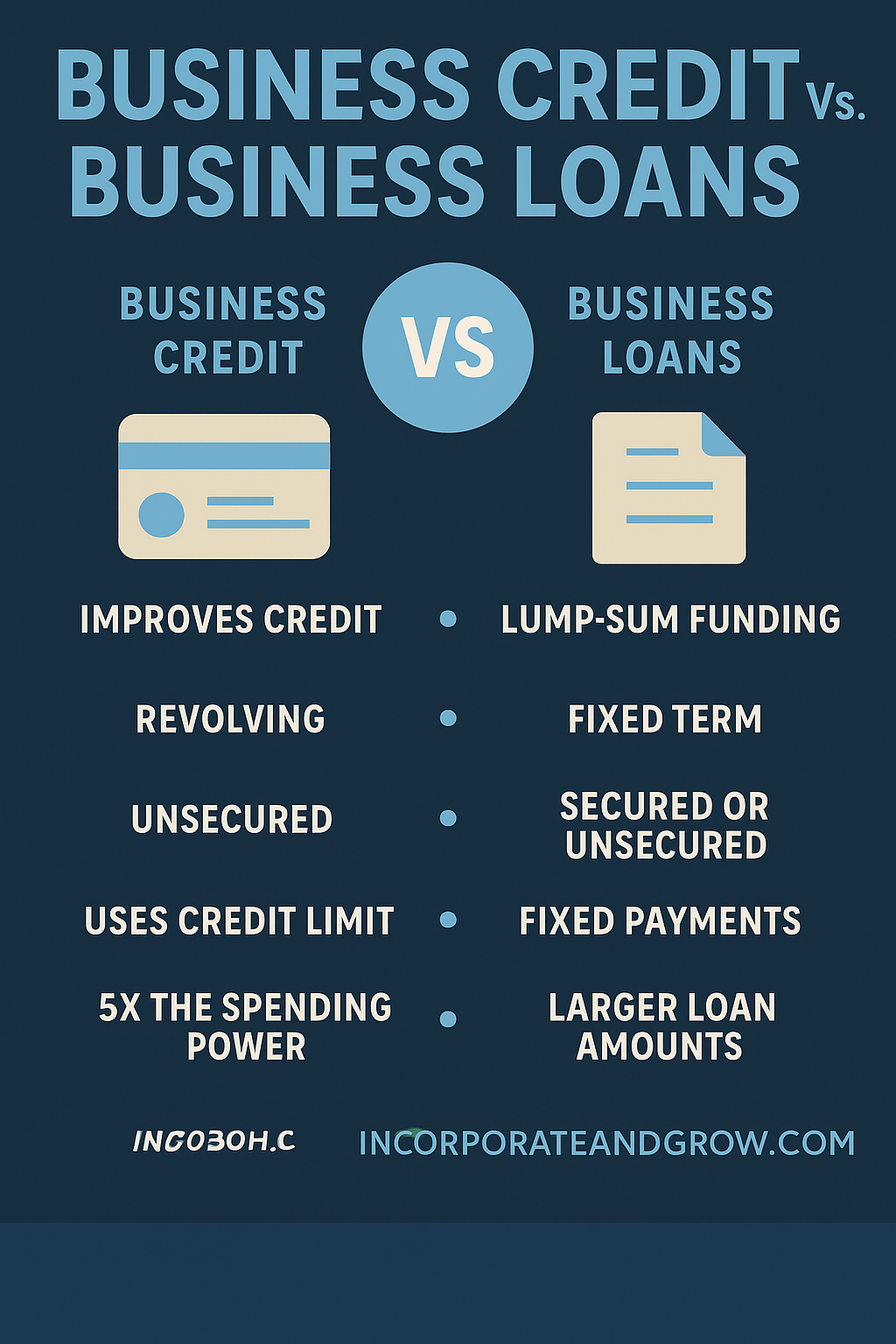

What Is Business Credit?

[cite_start]Business credit allows your company to borrow money or access financial tools, such as credit cards and lines of credit, under your business’s name and EIN (Employer Identification Number)—not your personal Social Security Number. [cite: 284, 285, 286] Instead of relying solely on your personal credit score, lenders assess your business’s creditworthiness, payment history with vendors, revenue, and entity structure. Building robust business credit offers significant advantages for accelerating growth, providing a distinct path from traditional startup business loans.

- Access to business credit cards with 0% intro APR, providing interest-free working capital for a period.

- Obtain lines of credit that can grow with your business, offering flexible access to funds as needed. Learn more about securing a business line of credit with bad credit.

- Establish vendor accounts and trade credit to manage expenses and preserve valuable cash flow.

- Qualify for higher funding limits than what’s typically available through personal credit.

The best part? When properly established and managed, business credit protects your personal FICO score and personal assets, as it doesn’t require you to put your own property on the line. This separation is key for sustainable, low-risk growth, especially for new ventures focusing on building business credit for startups.

What Is a Business Loan?

A business loan is a lump sum of money borrowed from a lender (like a traditional bank, credit union, or private financing company) that you repay with interest over a predetermined period. [cite_start]These loans are typically used for specific, larger investments or long-term capital needs. [cite: 284, 285, 286]

There are many types of business loans, each suited for different purposes:

- Term loans: Fixed lump sum repaid over a set period, suitable for large one-time investments. Compare them to lines of credit in our business line of credit vs. term loan guide.

- SBA loans: Government-backed loans with favorable terms, though often with a lengthy application process. Explore the differences between SBA 7(a) vs. SBA 504 loans.

- Equipment financing: Loans specifically for purchasing new machinery or equipment.

- Merchant cash advances: A lump sum advanced against future credit card sales, with repayment tied to daily sales.

- Invoice factoring: Selling your outstanding invoices to a third party for immediate cash. For similar fast capital solutions, see our guide on payroll loans for small businesses.

While business loans can be powerful — especially if you qualify for low interest rates and large amounts — they often come with specific challenges:

- Long approval times: Can take weeks to months to process and fund.

- Extensive documentation: Requires detailed business plans, financial statements, and tax returns. For a smoother process, check our SBA loan checklist for 2025.

- Personal guarantees: Often required, putting your personal assets at risk if the business defaults.

- Rigid repayment terms: Fixed monthly payments that may not align with fluctuating cash flow.

That’s why newer businesses or founders without strong credit history or significant collateral often find traditional business loans harder to access, making solutions like no-doc business loans or fastest business loans for startups more appealing.

Business Credit vs Business Loans: Head-to-Head Comparison for Founders

To help you decide which path is best for your business’s growth, here’s a direct comparison of business credit vs business loans:

| Criteria | Business Credit | Business Loans |

|---|---|---|

| Approval Speed | Fast (days to a few weeks) | Slower (weeks to several months) |

| Requirements | Established business entity, clean payment history, optimized business credit profile | High revenue, strong personal/business credit scores, extensive documentation, often collateral |

| Collateral Required | Often none (unsecured options common) | Usually required for larger loans |

| Personal Guarantee | Not always required (especially with established credit) | Often required, especially for small businesses |

| Flexibility of Use | Very flexible (credit cards for expenses, lines of credit for working capital, vendor accounts) | Fixed (lump sum for specific purposes like equipment, real estate, or large projects) |

| Best For | Startups, online businesses, real estate investors, e-commerce brands, consultants needing working capital or short-term liquidity | Established businesses with significant assets and consistent revenue seeking large, long-term capital for expansion or specific investments |

Featured Partner: National Funding for Fast Business Loans

If your established business needs quick working capital and prefers the speed of a loan with minimal hassle, National Funding offers a streamlined solution. They provide up to $500,000 in as little as 24 hours with a remarkably simple application process. Read our full review: National Funding Business Loans: Requirements, Rates (2025).

- Businesses with 6+ months in operation.

- Companies with $250K+ in annual revenue.

- Founders who need fast access to cash for immediate opportunities or short-term needs.

- U.S.-based companies with FICO scores of 600+.

Their process is designed for efficiency:

- Application + 4 months of bank statements = fast approval.

- No traditional SBA paperwork required, cutting down on bureaucracy.

- Provides fast, flexible, and accessible funding when time is critical.

Featured Partner: Fund & Grow for Building Business Credit

If you’re looking to strategically build business credit and tap into $50,000–$250,000 in unsecured business credit lines and cards, Fund & Grow is one of the top-rated solutions available today. They specialize in helping businesses acquire significant amounts of 0% introductory APR credit. For details on their credit score requirements, see our article on Fundwise Credit Score Requirements for Unsecured Funding, as Fund & Grow often works with Fundwise.

Why Fund & Grow is ideal for building credit for growth:

- Access to 0% intro APR business credit cards, allowing you to use capital interest-free for extended periods.

- No personal guarantee required on much of the credit they help you obtain, protecting your personal assets.

- No collateral required, making it accessible even without significant business assets.

- They handle the entire, complex application and negotiation process for you, saving time and maximizing approvals.

- Backed by over 1,000 verified testimonials from successful clients.

- Ideal for startups, real estate investors, consultants, and e-commerce businesses focused on leveraging credit for rapid scaling.

Bonus: Build Credit and Track Finances the Smart Way

Regardless of whether you pursue business credit or business loans, having proper financial management tools is crucial for presenting a strong case to lenders and managing your growth. These tools help you build creditworthiness and maintain organized records:

- Bench – Offers done-for-you bookkeeping services, ensuring your financial records are always accurate and ready for loan applications.

- Xero – Provides beautiful, intuitive cloud-based accounting software for managing invoices, expenses, and cash flow in real-time. For more on managing your books, explore our small business bookkeeping and payroll guide.

Pro tip: Clean, consistent bookkeeping is one of the biggest green flags for lenders and can significantly speed up your funding application process, whether for credit lines or loans. This is essential for any business aiming for quick capital, as discussed in our article on getting a business loan in 24 hours.

Internal Resources to Help You Fuel Growth

Explore more in-depth guides to optimize your business for funding and growth:

- Business Loan vs. Business Credit Card: Which is Right for Your Startup?

- LLC, S-Corp, C-Corp: Choosing Your Business Structure for Startup Funding

- LLC vs. C-Corp for Startups: Funding Implications Compared

- Best Business Bank Accounts for Startups

- How to Create a Winning Investor Pitch Deck

- Business Loan Approval Checklist: Qualify Faster

- Small Business Grants Guide: Your Roadmap to Non-Dilutive Funding

Frequently Asked Questions

What are the primary differences between business credit and business loans?

Business credit typically involves credit cards and lines of credit under your EIN, offering flexibility and protecting personal assets. Business loans are lump sums with fixed repayment terms, often used for specific large investments, and may require personal guarantees or collateral.

Which is better for a new startup, business credit or a business loan?

For new startups, building strong business credit is often preferred. It can offer more flexibility, protect personal assets, and be easier to access without extensive revenue or collateral, unlike many traditional business loans.

Can I get business credit with bad personal credit?

Yes, while personal credit can influence initial approvals, focusing on building a separate business credit profile can eventually allow you to obtain business credit and financing independently of your personal score.

How can I build business credit effectively?

To build business credit, ensure your business is properly structured (e.g., LLC or C-Corp), obtain an EIN, open a dedicated business bank account, and establish vendor accounts that report to business credit bureaus. Regularly pay bills on time and monitor your business credit reports.

Final Thoughts: Strategic Funding for Sustainable Growth

Choosing between business credit and business loans is a strategic decision that impacts your business’s ability to grow. While loans offer large lump sums, business credit provides flexibility and protection, often making it the preferred route for newer businesses seeking to scale without taking on immediate debt or personal risk.

By understanding both options and leveraging trusted partners like National Funding for quick loans or Fund & Grow for building business credit, you can make informed choices that fuel faster, more sustainable growth for your venture. The key is to assess your immediate needs and long-term goals to determine the best financial pathway forward.

Disclosure: Some of the links on this page are affiliate links. This means we may earn a commission at no extra cost to you if you make a purchase through one of our partners.