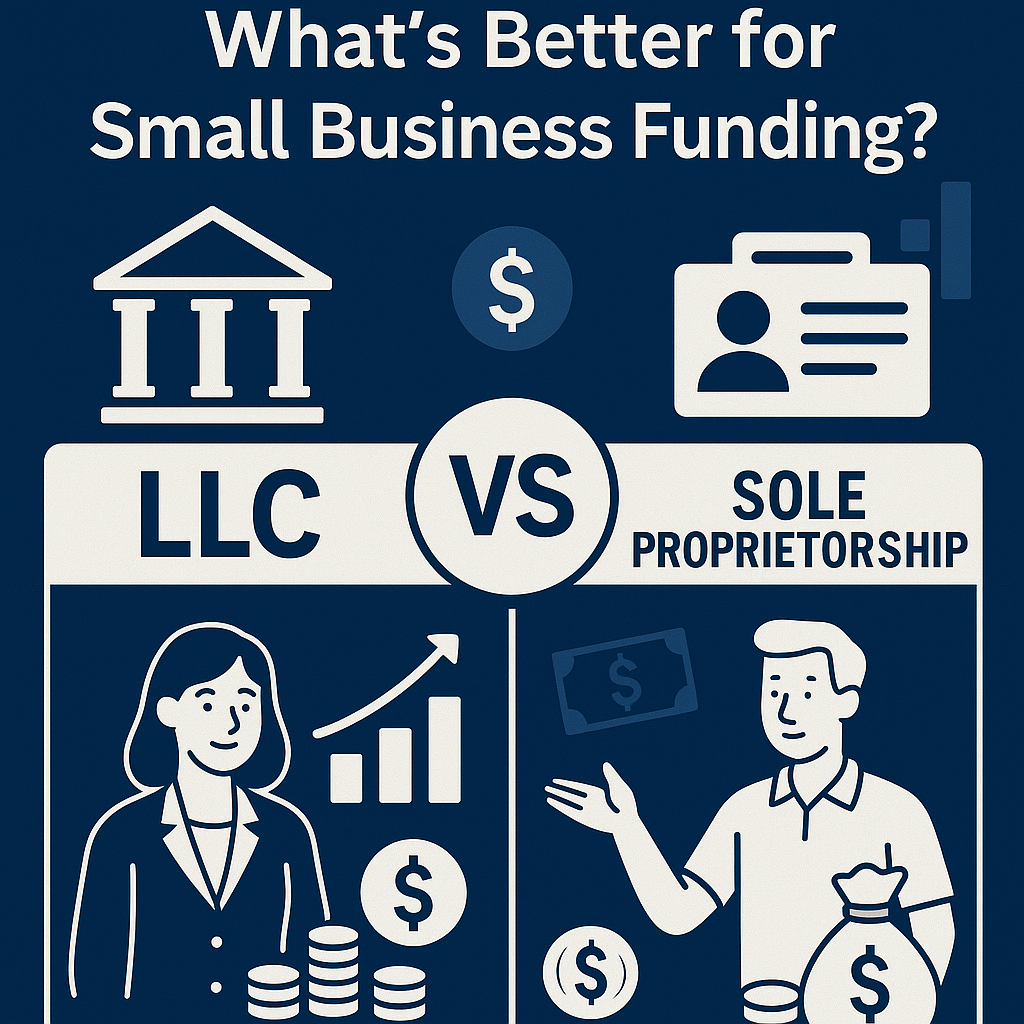

Choosing the Right Structure to Fund Your Business

When you’re launching a new business, choosing the right legal structure can dramatically shape your access to funding. Whether you’re applying for a loan, opening business credit cards, or attracting outside investment, the foundation matters. Most new entrepreneurs begin as sole proprietors because it’s simple. But is that the best move for your financial future and ability to secure funding?

Let’s compare two of the most common small business structures: Sole Proprietorship vs. LLC (Limited Liability Company), to determine which offers better access to funding, credit, and growth opportunities.

What Is a Sole Proprietorship?

A sole proprietorship is the simplest business entity. It’s not a formal legal structure but rather the default status when one person starts doing business under their own name (or a DBA—”Doing Business As”). There’s no legal separation between you and your business.

Pros of a Sole Proprietorship:

- Easy and inexpensive to set up

- No separate tax filing for the business (income and expenses reported on your personal tax return, Schedule C)

- Total control over the business

Cons of a Sole Proprietorship:

- No liability protection (your personal assets are at risk for business debts and lawsuits)

- Harder to separate personal and business finances

- Less credibility with lenders and investors

- Cannot issue stock or raise equity easily

Funding Challenges for Sole Proprietors

Most banks, lenders, and business credit bureaus want to see a registered legal entity when evaluating applications. Sole proprietors often struggle to:

- Qualify for dedicated business credit cards or loans, often relying solely on personal credit

- Build a distinct business credit profile, which limits access to larger funding amounts

- Appear credible and professional to outside investors who seek established legal structures

What Is an LLC (Limited Liability Company)?

An LLC is a formal legal business entity that separates your personal assets from your business operations. It’s recognized by all 50 states and is a go-to choice for freelancers, ecommerce brands, agencies, and tech startups seeking both flexibility and protection.

Pros of an LLC:

- Liability protection for the owner(s) (personal assets are protected from business debts and lawsuits)

- Separate tax and financial identity for the business

- Builds trust and credibility with banks, investors, and partners

- Can choose how you’re taxed (default pass-through, or elect S-Corp later for tax savings)

- Easier to transfer ownership or raise capital in the future

Cons of an LLC:

- Requires state filing fees and often annual renewal fees

- More administrative responsibilities and compliance requirements than a sole proprietorship (e.g., maintaining an operating agreement)

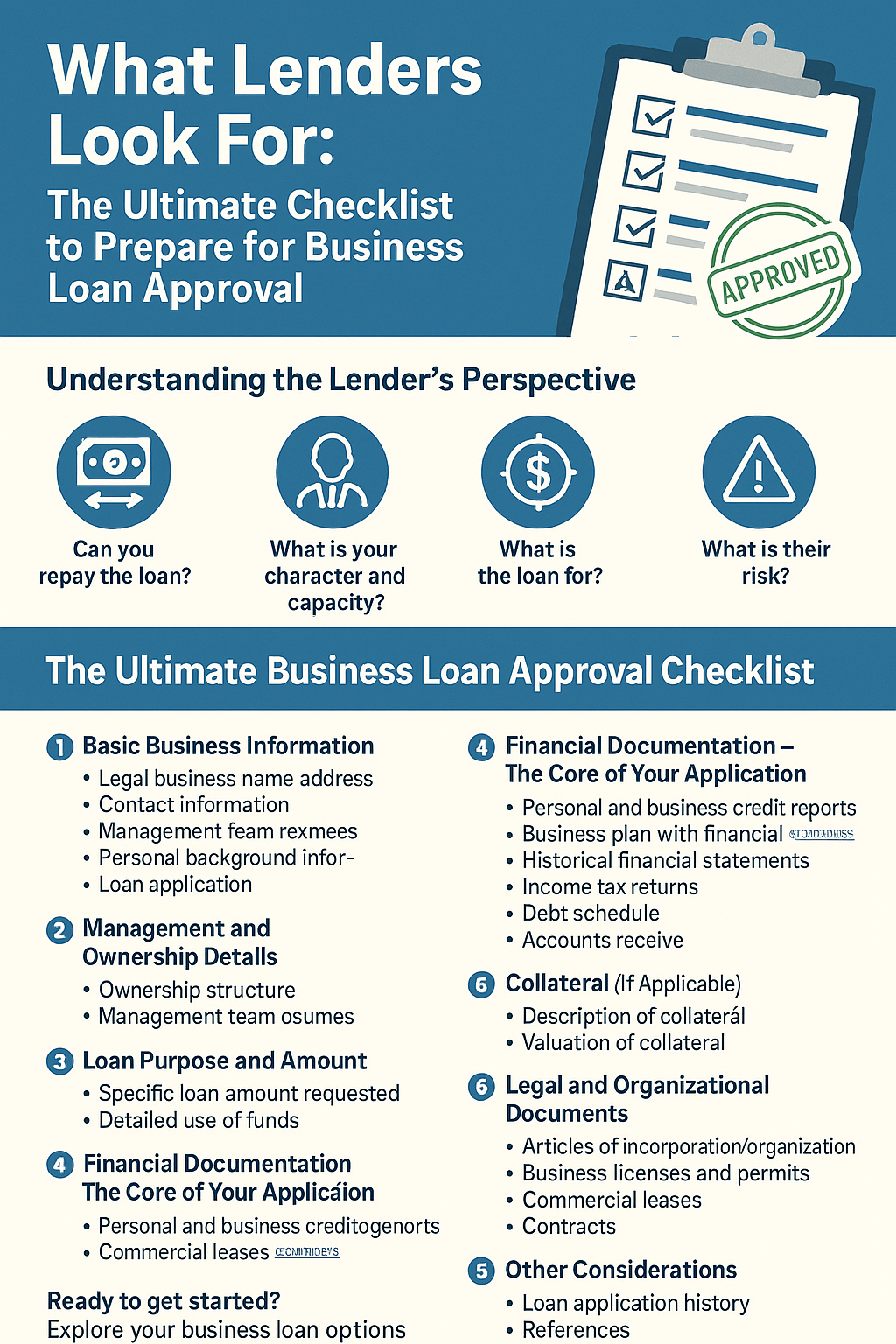

Why Lenders Prefer LLCs for Business Funding

Lenders and funding platforms typically view LLCs as more stable, professional, and credible entities. That’s because an LLC:

- Allows you to obtain an EIN (Employer Identification Number), which is crucial for establishing a business identity separate from your personal one.

- Enables you to open dedicated business bank accounts, which is a fundamental requirement for most business loans and credit cards.

- Facilitates the ability to build a true business credit profile, independent of your personal credit score. This separation is key for securing better loan terms and higher credit limits as your business grows.

- Signifies a commitment to formality and legal compliance, which reduces perceived risk for lenders.

All of this makes it significantly easier to get approved for funding like:

- 0% interest business credit lines with Fund&Grow

- Up to $150K in unsecured funding from FundWise Capital

- Traditional bank loans and SBA loans

- Business credit cards for daily expenses and cash flow management

Sole Proprietorship vs. LLC: Side-by-Side Comparison for Funding

| Feature | Sole Proprietorship | LLC |

|---|---|---|

| Legal Protection | None (personal assets at risk) | Yes (personal assets protected) |

| Ease of Setup | Very Easy (default status) | Easy (simple filing process) |

| Tax Flexibility | No (personal income only) | Yes (can elect S-Corp for tax savings) |

| EIN Requirement | Optional (can use SSN) | Required for employees, recommended for all |

| Business Credit Access | Limited (relies on personal credit) | Strong (can build separate business credit) |

| Loan Eligibility | Low (often personal loans) | Higher (access to business-specific funding) |

| Investor Appeal | Low (not designed for equity) | Moderate to High (can be appealing for debt/some equity) |

| Perceived Professionalism | Low | High |

When Should You Upgrade to an LLC for Better Funding Opportunities?

While starting as a sole proprietorship is easy, there comes a point where the benefits of an LLC far outweigh the simplicity. You should strongly consider forming an LLC if:

- You’re making more than $5,000/year in revenue and your business activities create potential liability.

- You plan to apply for business funding (loans, credit lines) in the next 6-12 months.

- You want to build a strong business credit profile separate from your personal credit.

- You want to protect your personal assets (home, savings) from business debts and lawsuits.

- You’re entering into formal contracts with clients or vendors.

- You plan to hire employees or grow a team.

Setting up an LLC is fast and affordable with Northwest Registered Agent. They include privacy protection and free tools to maintain compliance, making the process straightforward.

Don’t Forget the Essential Financial Tools for Your LLC

Once your LLC is in place, set it up for financial success with the right support tools. These platforms are crucial for maintaining accurate records, which is vital for both tax compliance and attracting funding:

- Xero: Cloud accounting for tracking expenses, invoices, and cash flow. Essential for clear financial statements.

- Bench: Outsourced bookkeeping for growing businesses. Ideal for busy founders who need professional, accurate books without doing it themselves.

These platforms help you present accurate and organized financial books, which significantly improves your credibility and chances when applying for business loans or lines of credit.

Final Thoughts: Choose Smart for Long-Term Growth and Funding

Starting as a sole proprietor is fine if you’re testing an idea or have very minimal risk. But if you’re serious about scaling, protecting your personal assets, and unlocking significant funding opportunities, an LLC is the smarter play for sustained growth.

Your legal structure affects everything from credit access to investor interest to how much you pay in taxes. Make an informed decision that aligns with your business goals.

Ready to Structure Your Business for Funding Success?

- Set up your LLC quickly and easily with Northwest Registered Agent.

- Apply for early-stage funding with FundWise Capital or explore 0% interest lines with Fund&Grow.

- Simplify your business finances with Xero or Bench.

- For more in-depth comparisons, read our guide: LLC vs. S-Corp vs C-Corp: Choosing the Best Structure for Funding

Next up? Learn how to build business credit for your LLC and get approved for funding without going into debt. Coming soon on IncorporateAndGrow.com.